Navigating the Competitive Landscape: Insights for Ross Dress for Less in San Diego

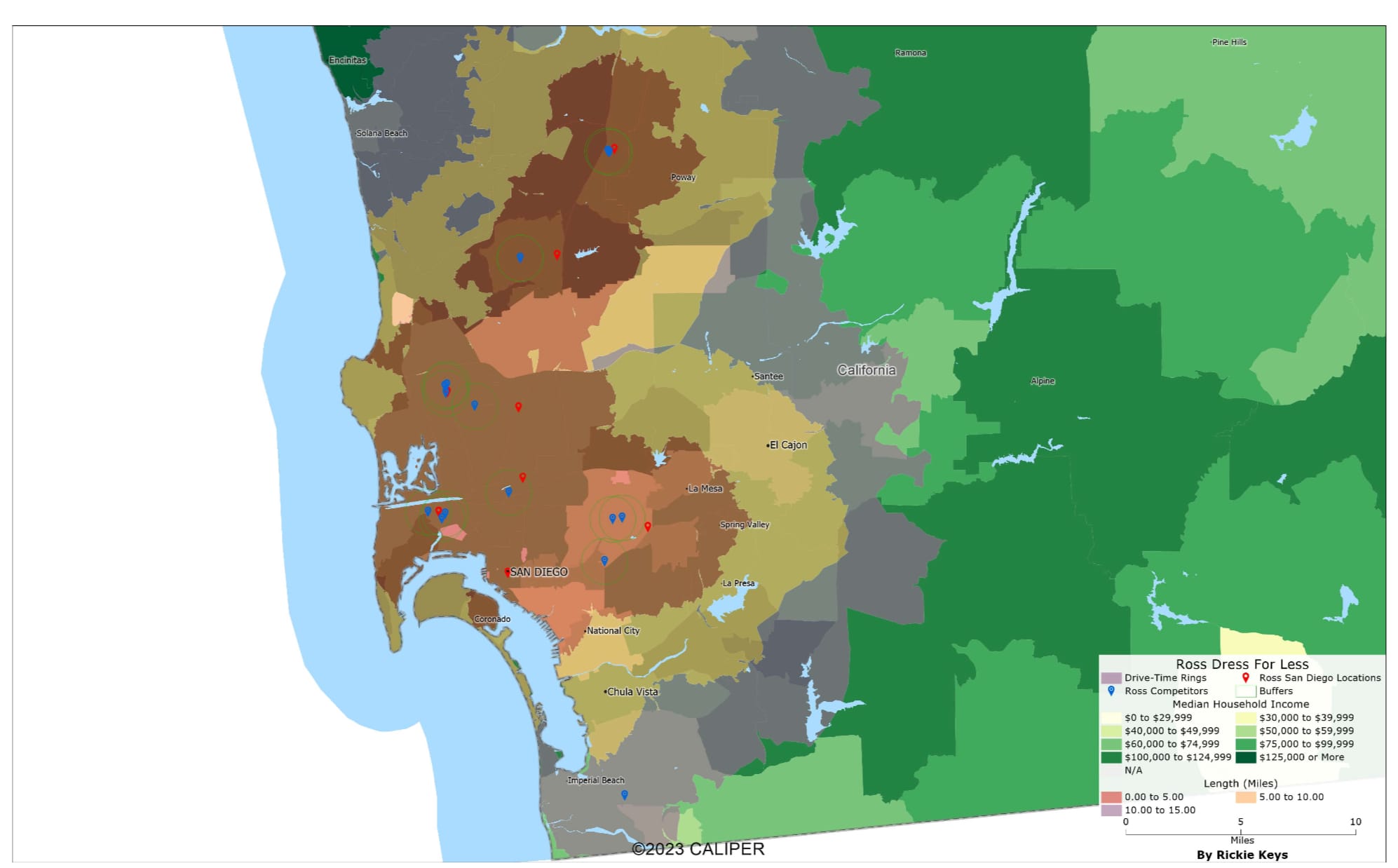

In the ever-evolving retail environment of San Diego, CA, understanding the competitive landscape is crucial for brands aiming to maintain and enhance their market position. For Ross Dress for Less, a leading off-price department store chain, the strategic allocation of resources and targeted marketing efforts are vital components of its business strategy. This post delves into two key aspects of the competitive environment in San Diego: the presence of competitors by ZIP Code and the Competitive Intensity Index, offering insights that could guide decision-making processes at Ross.

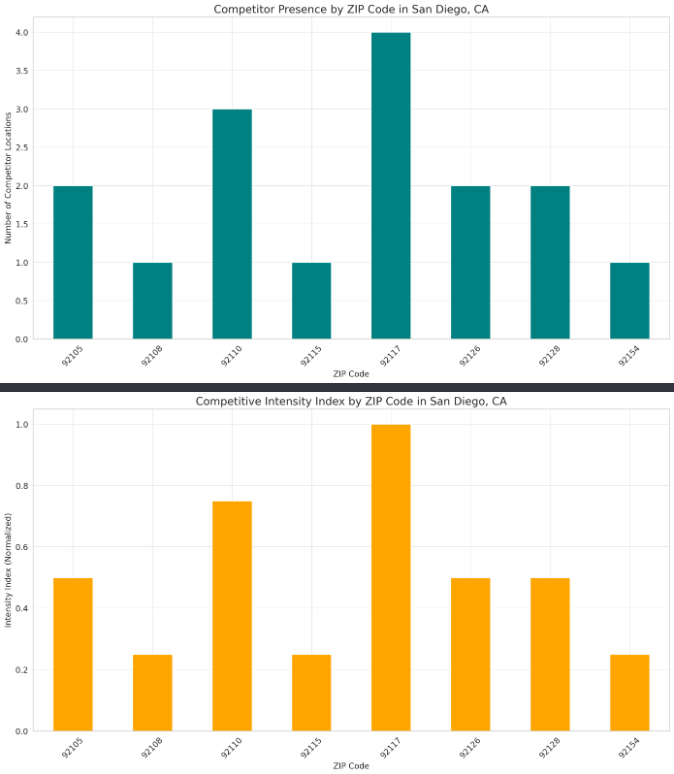

Competitor Presence by ZIP Code

Our analysis begins with an examination of competitor presence by ZIP Code, providing a proxy for analyzing competitor distribution across neighborhoods or districts within San Diego. The visualization below illustrates the number of Ross's competitors in each ZIP Code, highlighting high and low competitive density areas.

This distribution offers a clear view of Ross's competitive pressures, with certain ZIP Codes showing higher concentrations of competitors. These areas are hotspots for competition, necessitating strategic measures from Ross to bolster its competitive edge, possibly through localized marketing strategies, competitive pricing, and a diverse product mix tailored to local consumer preferences.

Competitive Intensity Index

To further refine our understanding, we constructed a Competitive Intensity Index for each ZIP Code, normalized to reveal the relative intensity of competition Ross faces. The index provides a simple yet effective measure of how competitors are concentrated within specific areas, emphasizing ZIP Codes where the competitive battle is most intense.

The Competitive Intensity Index offers a nuanced perspective, pinpointing ZIP Codes where Ross needs to focus its strategic efforts to either defend its market share or identify untapped opportunities for growth.

Insights and Strategic Implications

Identifying High-Competition Areas

Ross encounters significant competitive pressure in areas with higher counts and intensity scores. These insights are invaluable for Ross's strategic planning, informing marketing, pricing, inventory management, and store layout decisions to enhance its appeal to local shoppers.

Opportunities for Expansion

ZIP Codes with lower competition intensity represent potential growth opportunities for Ross. Expanding or enhancing its presence in these areas could be strategically beneficial, provided they align with Ross's target demographics and accessibility standards.

Tailored Strategies

The granular view of the competitive landscape enables Ross to tailor its strategies to the specific context of each location. Customizing offerings based on local market dynamics, consumer preferences, and competitive pressures can significantly improve Ross's position and market share.

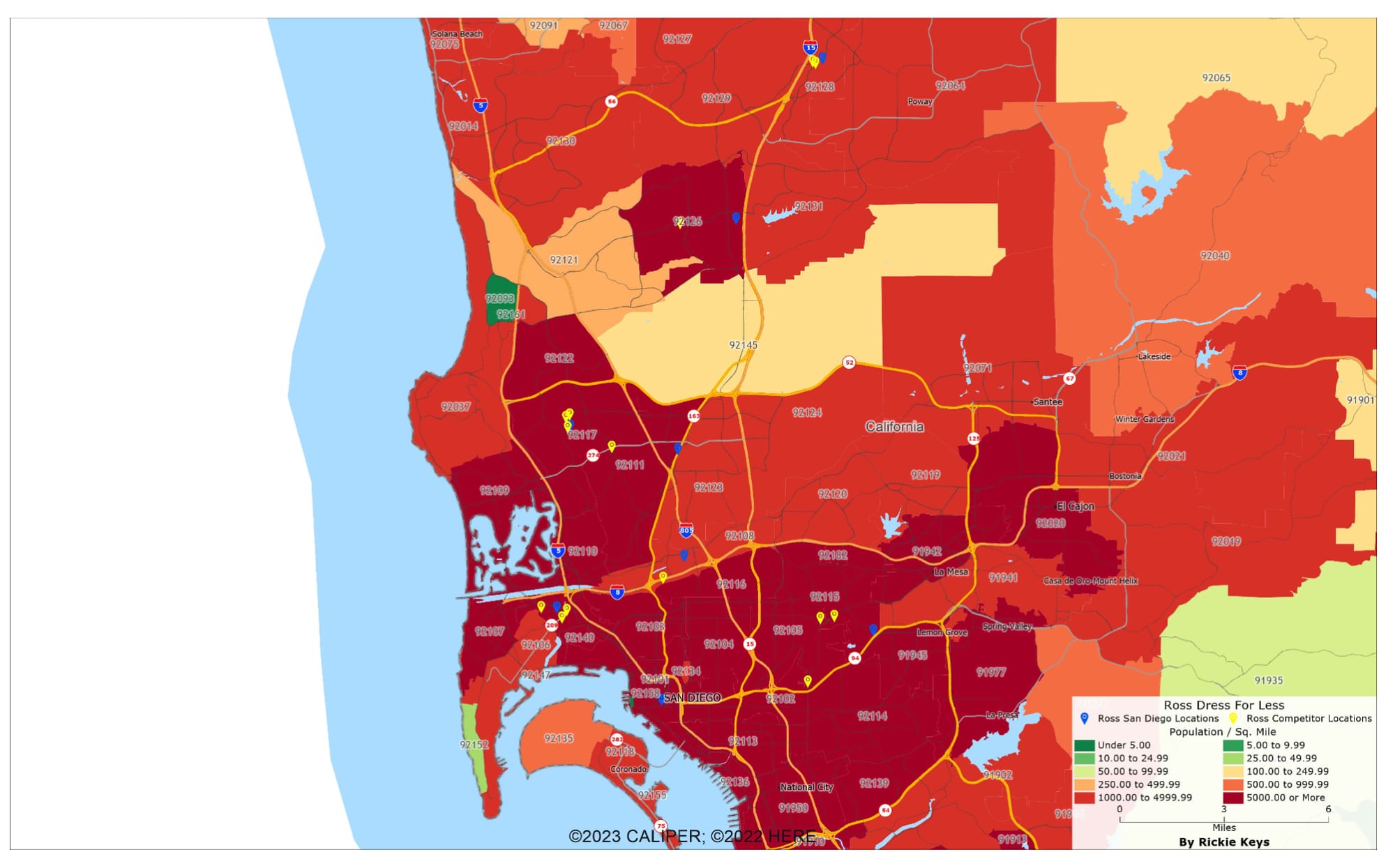

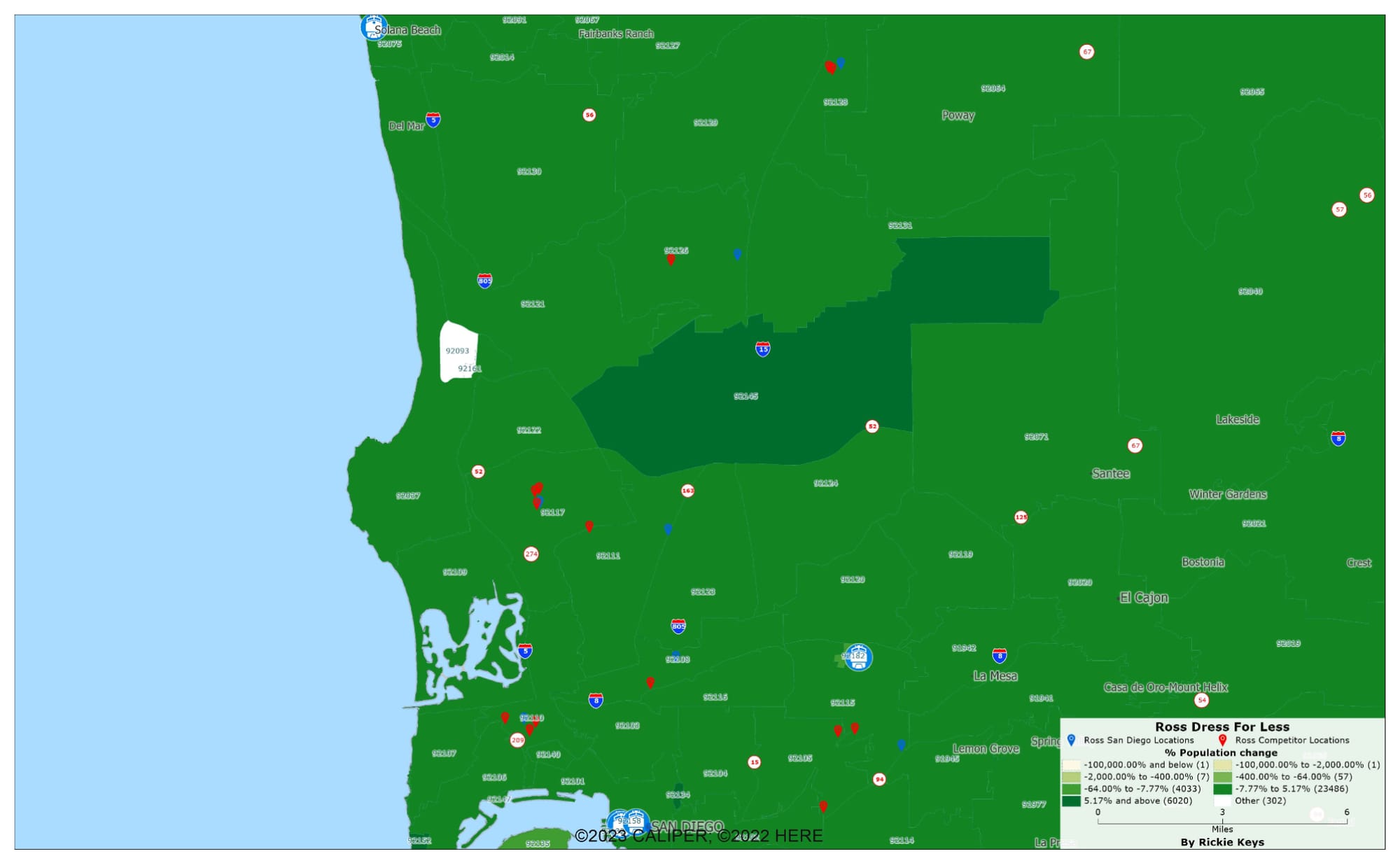

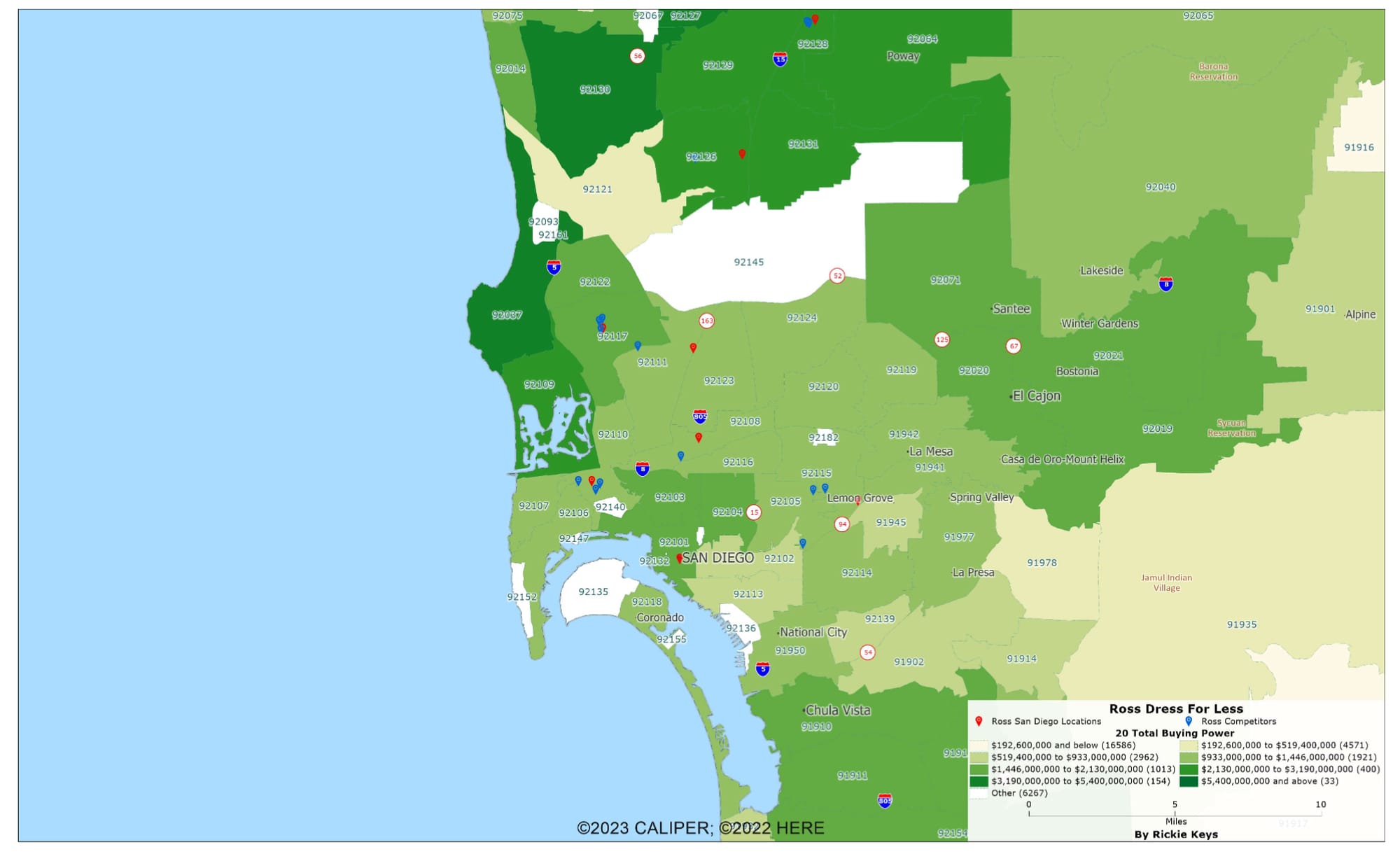

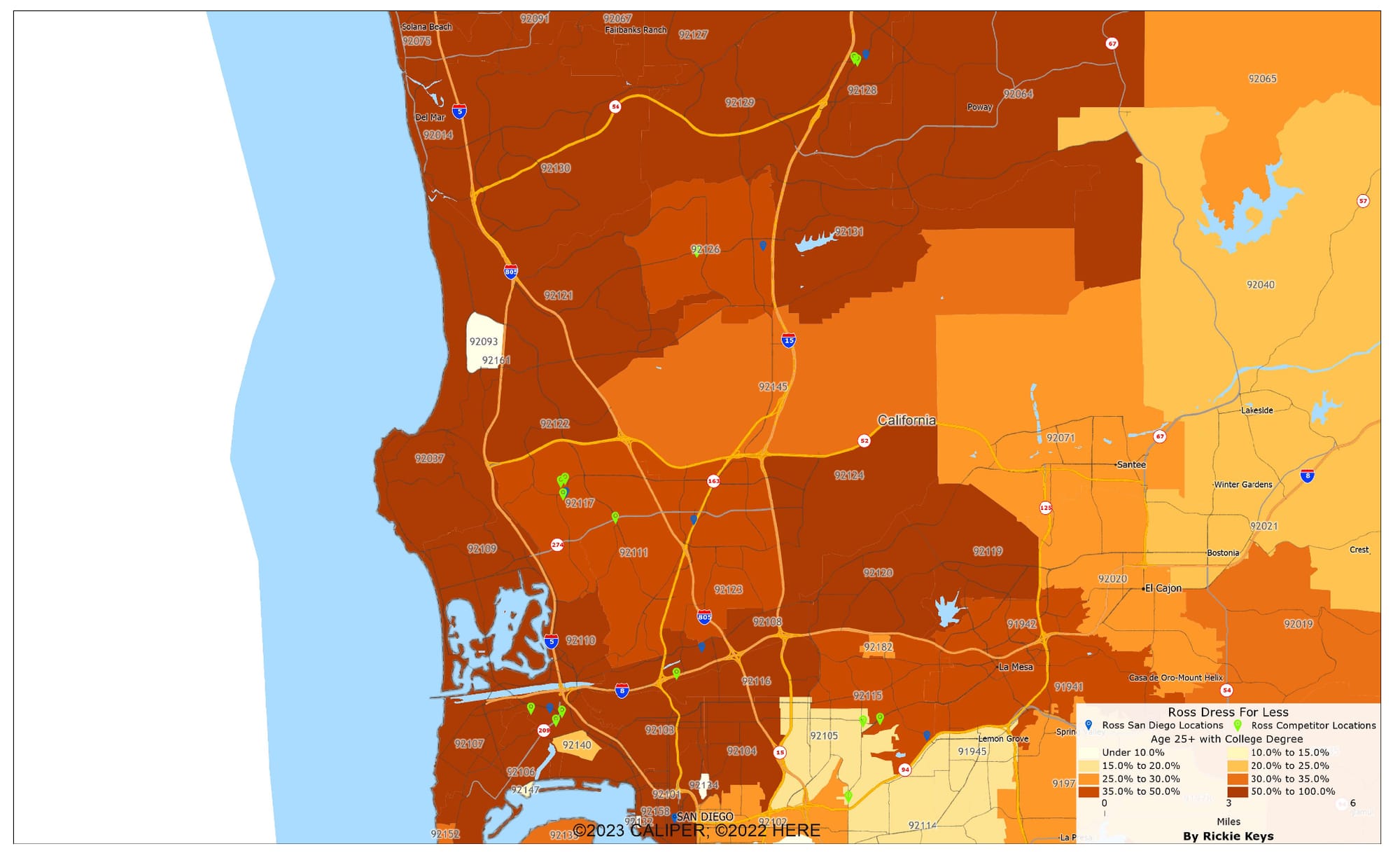

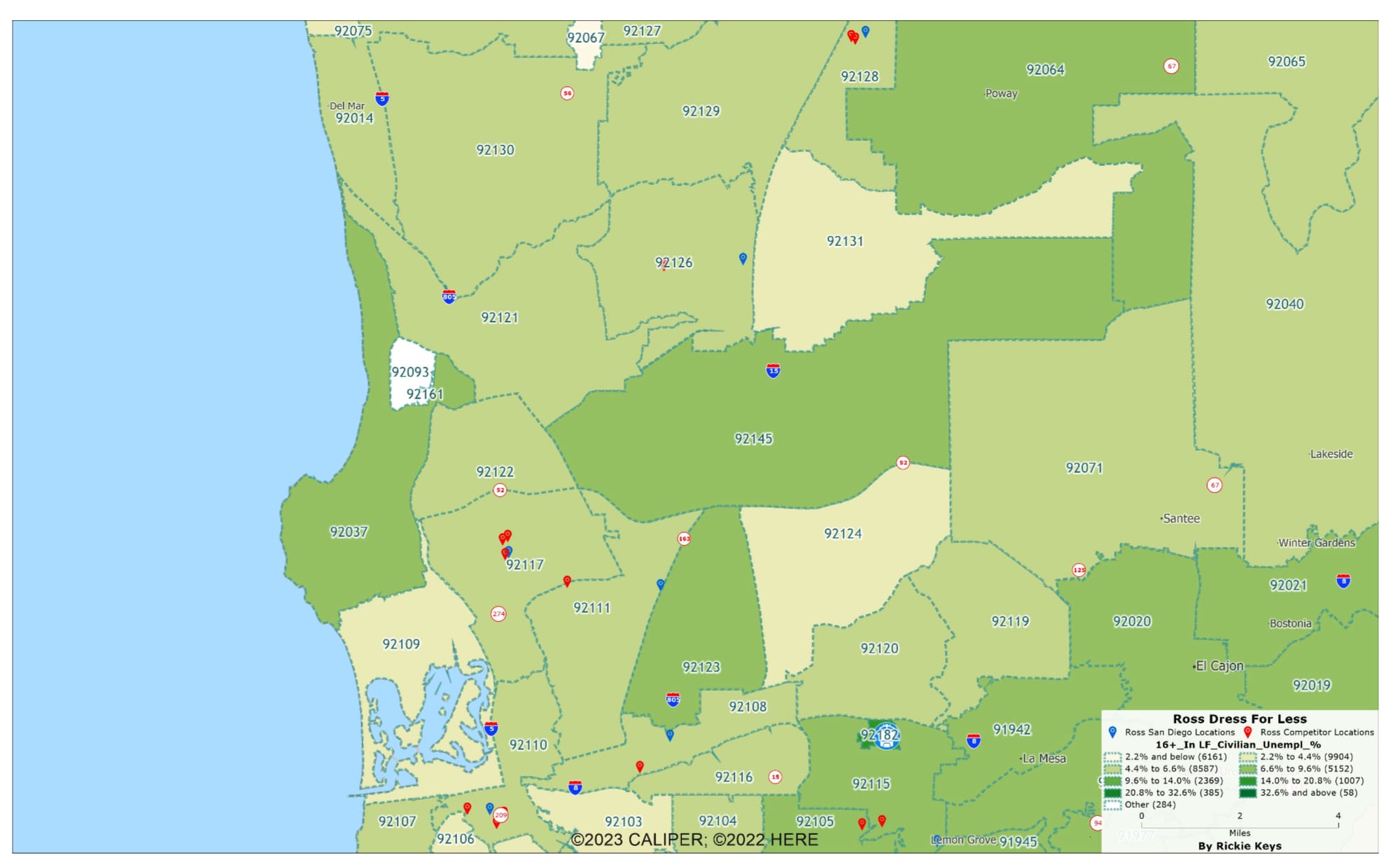

Understanding the Demographic Landscape

To complement our analysis, it's crucial to consider demographic factors associated with the San Diego market, including population density, percentage population change, buying power, education levels, and unemployment rates by ZIP Code. These factors provide a backdrop for the competitive analysis, offering insights into consumer behavior and market potential.

Population Density and Change: Areas with high population density or significant growth rates are likely to have higher consumer foot traffic, presenting both challenges and opportunities for Ross.

Buying Power: ZIP Codes with higher average incomes may offer more significant opportunities for premium product lines, whereas areas with lower average incomes might respond better to value-oriented offerings.

Education and Unemployment Rates: These indicators can influence consumer spending habits and preferences, guiding Ross's merchandise selection and marketing messages.

By integrating these demographic insights with the competitive analysis, Ross can craft more effective strategies that resonate with the San Diego market, driving growth and enhancing customer satisfaction.

Conclusion

For Ross Dress for Less, navigating the competitive landscape of San Diego requires a strategic blend of market intelligence, consumer insights, and adaptability. The analyses presented offer a roadmap for understanding competitive pressures and demographic nuances, laying the groundwork for informed decision-making and strategic planning. As the retail landscape continues to evolve, leveraging such insights will be crucial for Ross to maintain its competitive edge and achieve sustainable growth in the vibrant market of San Diego.