Bridging the Banking Divide: A Closer Look at Chicago's South Side

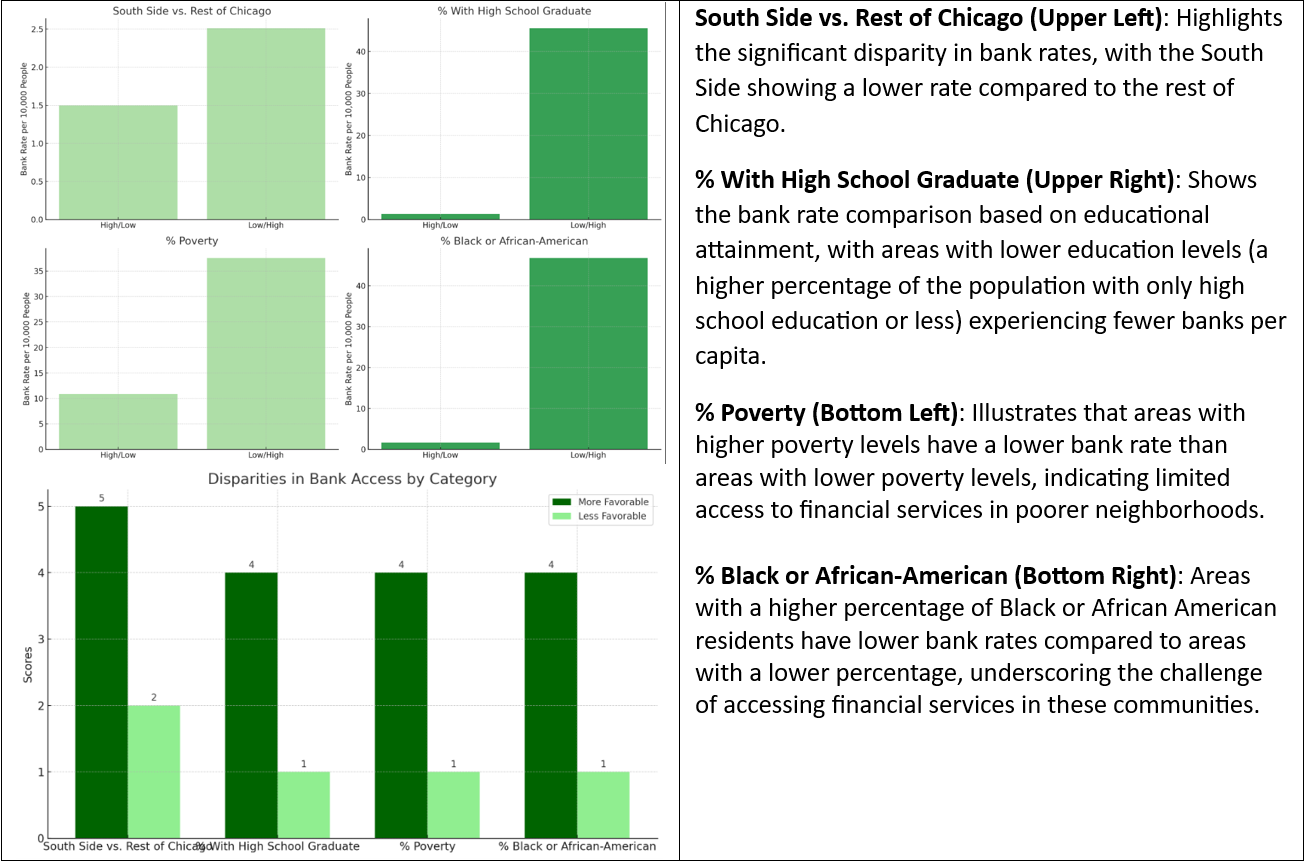

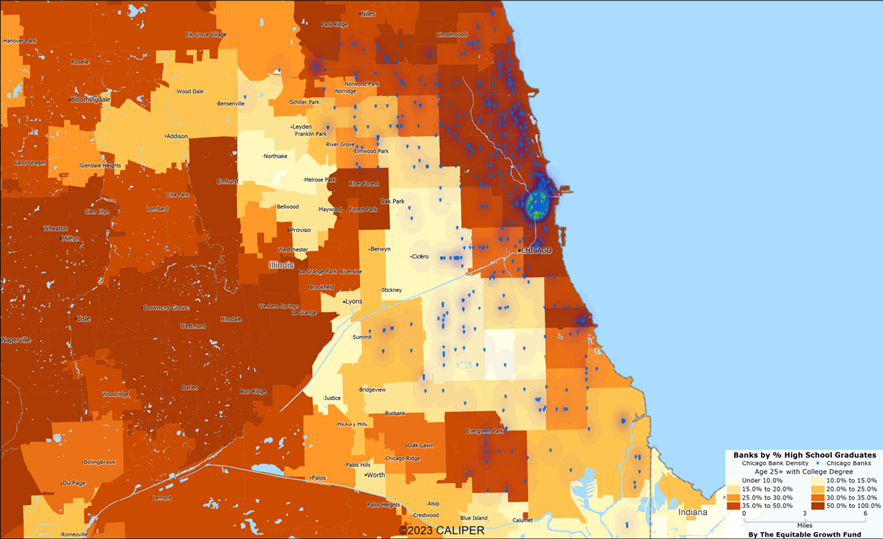

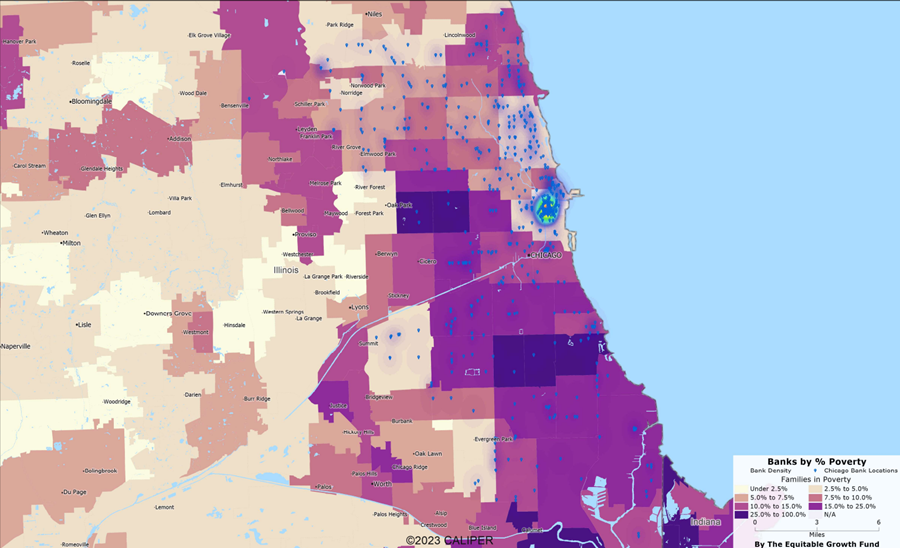

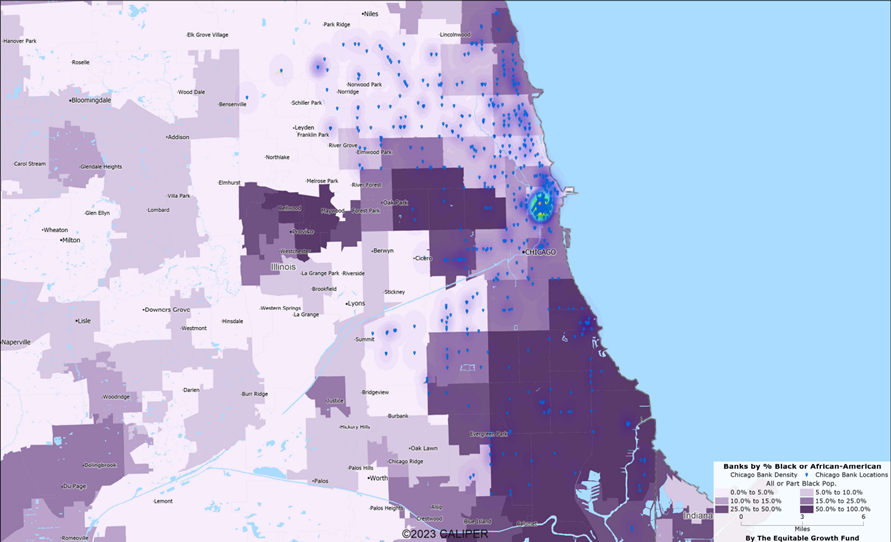

In the city of Chicago, a stark contrast emerges when examining access to mainstream banking services. Particularly in the South Side, as well as areas marked by higher poverty rates, lower levels of education, and a significant Black or African American population, the availability of such essential services falls short compared to the rest of the city. This discrepancy not only highlights a geographic divide but also underscores the socio-economic and racial barriers that limit financial inclusion for these communities.

Disparities in Banking Access Across Chicago

Geographic Disparities: The South Side of Chicago experiences notably fewer banking facilities than other parts of the city. This disparity points to a concerning trend where essential financial services are not equally accessible to all residents, impacting their ability to manage finances, access credit, and invest in future opportunities.

Educational and Economic Barriers: Further analysis reveals that areas with lower educational attainment and higher poverty rates face a similar shortage of banking options. These findings suggest a correlation where socio-economic challenges are compounded by limited access to financial tools and resources.

Racial Disparities in Financial Services: Neighborhoods with a higher percentage of Black or African American residents encounter fewer banking institutions. This trend highlights racial disparities in financial services access and calls attention to the broader issue of systemic inequality in financial infrastructure.

Strategies for Improvement

To address these disparities, several strategies can be considered:

- Policy Incentives: Enacting policies that encourage banks to establish branches in underserved areas could significantly improve access to financial services.

- Tailored Financial Education: Initiatives aimed at enhancing financial literacy in communities with lower education and higher poverty can help bridge the gap in banking access.

- Community-Focused Financial Entities: Partnerships between the public and private sectors to develop local credit unions or community banks offer a pathway to more inclusive banking solutions.

- Fair Access to Credit Act (FACA) Approach: Adopting regulatory frameworks like California's FACA, which caps interest rates on certain loans, can balance consumer access to credit while ensuring protections. This model has demonstrated success in promoting sustainable lending practices and expanding the availability of consumer loans.

Visualizing the Divide

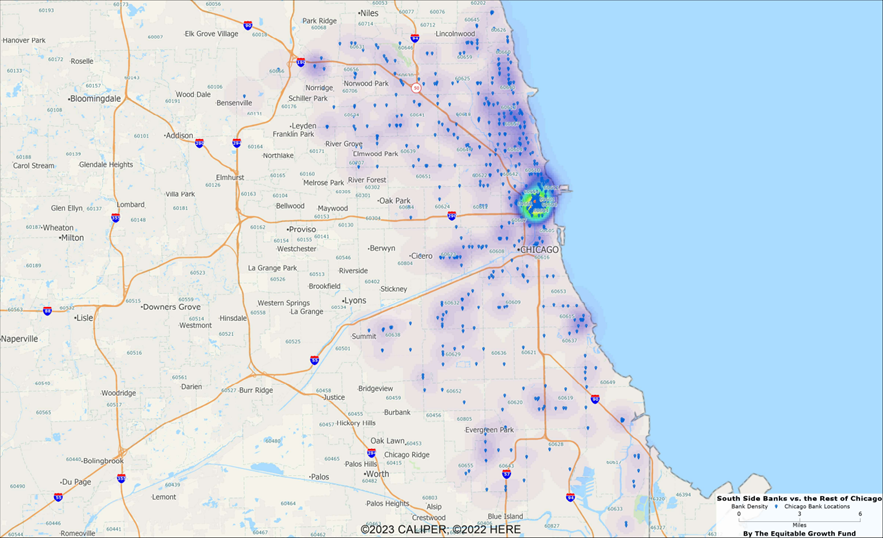

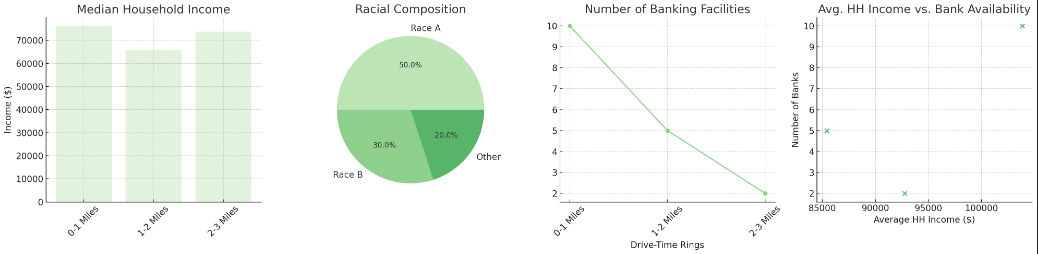

To further illustrate these disparities, a series of maps and charts have been developed:

- Bank Density Maps: These visualizations compare the concentration of banks across different areas, highlighting the lower density in the South Side, areas with lower high school graduation rates, higher poverty levels, and higher percentages of Black or African American residents. These maps starkly visualize the geographic, educational, and racial disparities in banking access.

- Economic Diversity and Banking Facilities Charts: Through detailed charts, we observe the variation in median household incomes and the distribution of banking facilities, shedding light on the economic diversity within the area and its influence on banking access. The correlation between average household income and bank availability is also explored, revealing economic barriers in lower-income communities.

Moving Forward

The insights drawn from these analyses and visualizations underscore the urgent need for targeted interventions to ensure equitable access to banking services across Chicago. By addressing the root causes of financial service disparities and implementing effective strategies for improvement, we can move closer to bridging the banking divide and fostering a more inclusive financial ecosystem for all residents of Chicago.