Financial Drought in New Mexico: Navigating the Bank Deserts Post House Bill 132

Introduction

In the world of consumer finance, legislative changes often come with the promise of improvement and protection. However, the real-world implications can be vastly different from the intended outcomes. This is the case with New Mexico's House Bill 132, which, though aimed at curbing high interest rates in small loans, has led to unintended consequences that have severely impacted consumers' access to credit.

The Intent Behind House Bill 132

The passage of House Bill 132 in New Mexico was a significant event in the state's financial landscape. The bill capped small loan interest rates at 36%. The bill's advocates suggested that major banks would step in to fill the lending void left by specialized small-dollar lenders, thereby providing consumers with fair and accessible lending options. However, the reality that unfolded was starkly different. Our comprehensive analysis of the New Mexico Regulations and Licensing Department Financial Institutions Division Annual Reports from 2011 to 2023 exemplifies this reality.

The Immediate Impact on Installment Lending

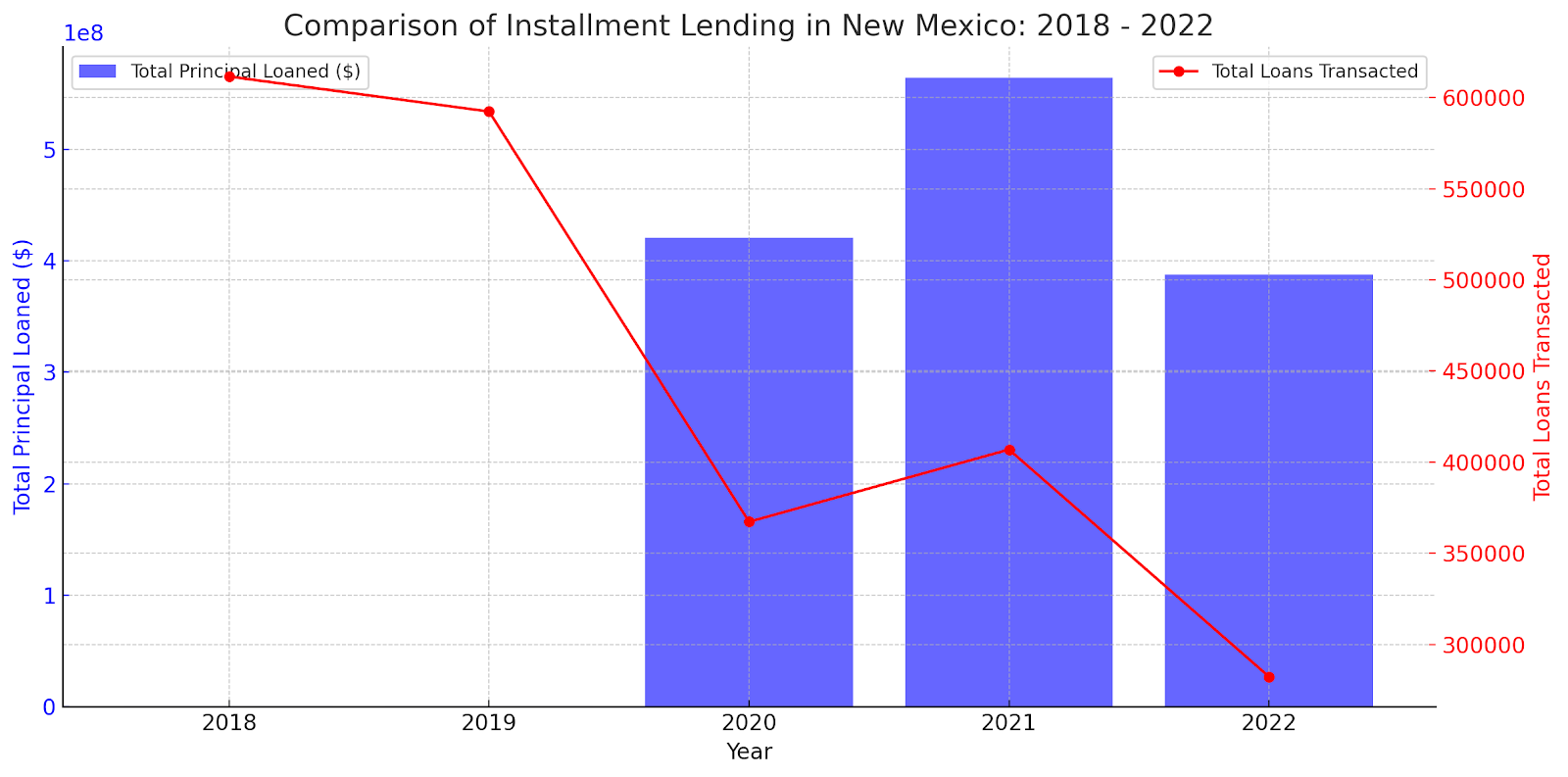

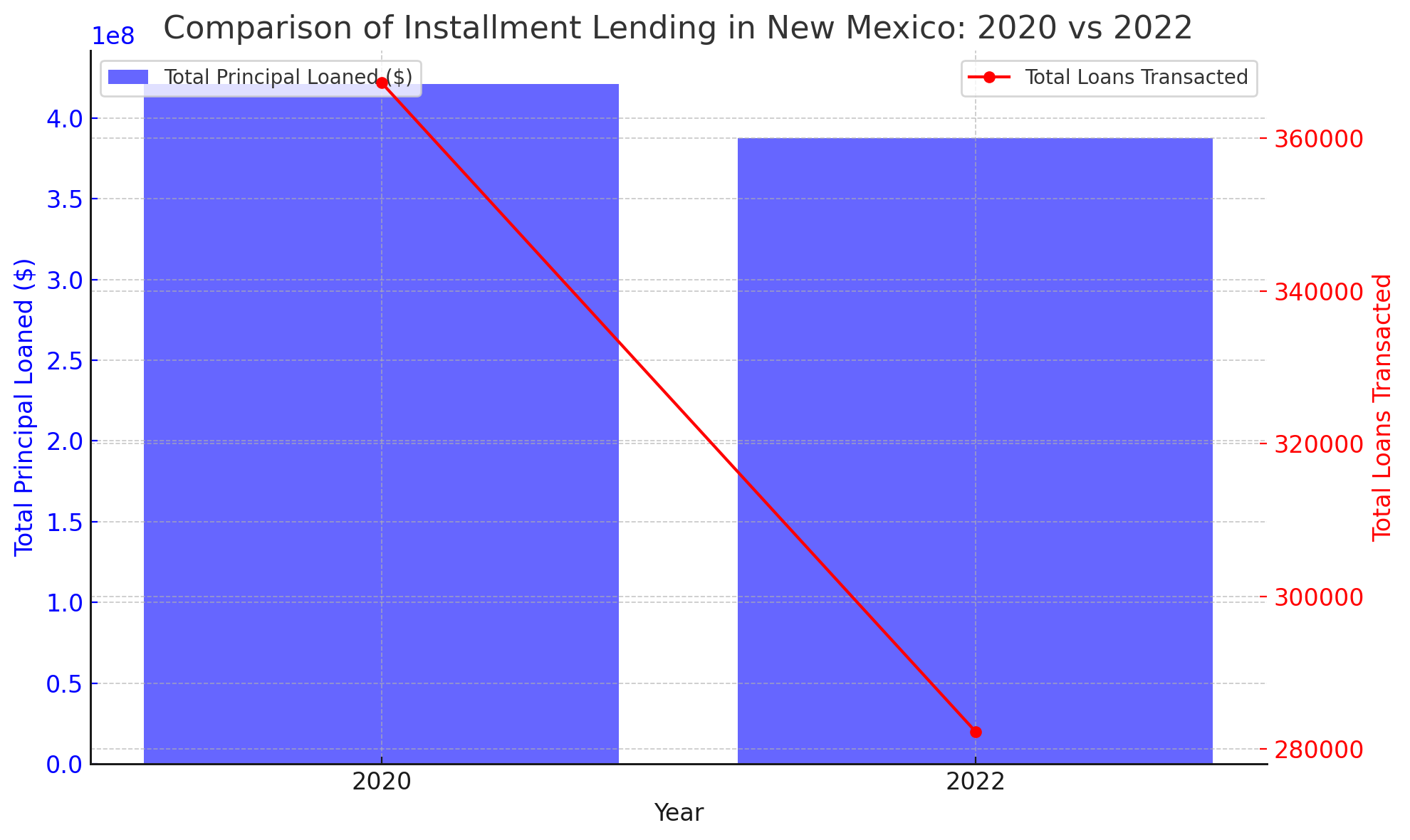

The first indication of the bill's impact is evident in the data from 2018 to 2022, as seen in the "Comparison of Installment Lending in New Mexico: 2018 - 2022" graph. The graph paints a clear picture: there was a significant increase in the total principal loaned and the number of loans transacted until 2021. However, the year 2022 witnessed a dramatic decline, indicating the immediate and stark impact of House Bill 132. This trend suggests a substantial contraction in the installment lending market, correlating with the bill's implementation.

County-Level Analysis: A Statewide Reduction

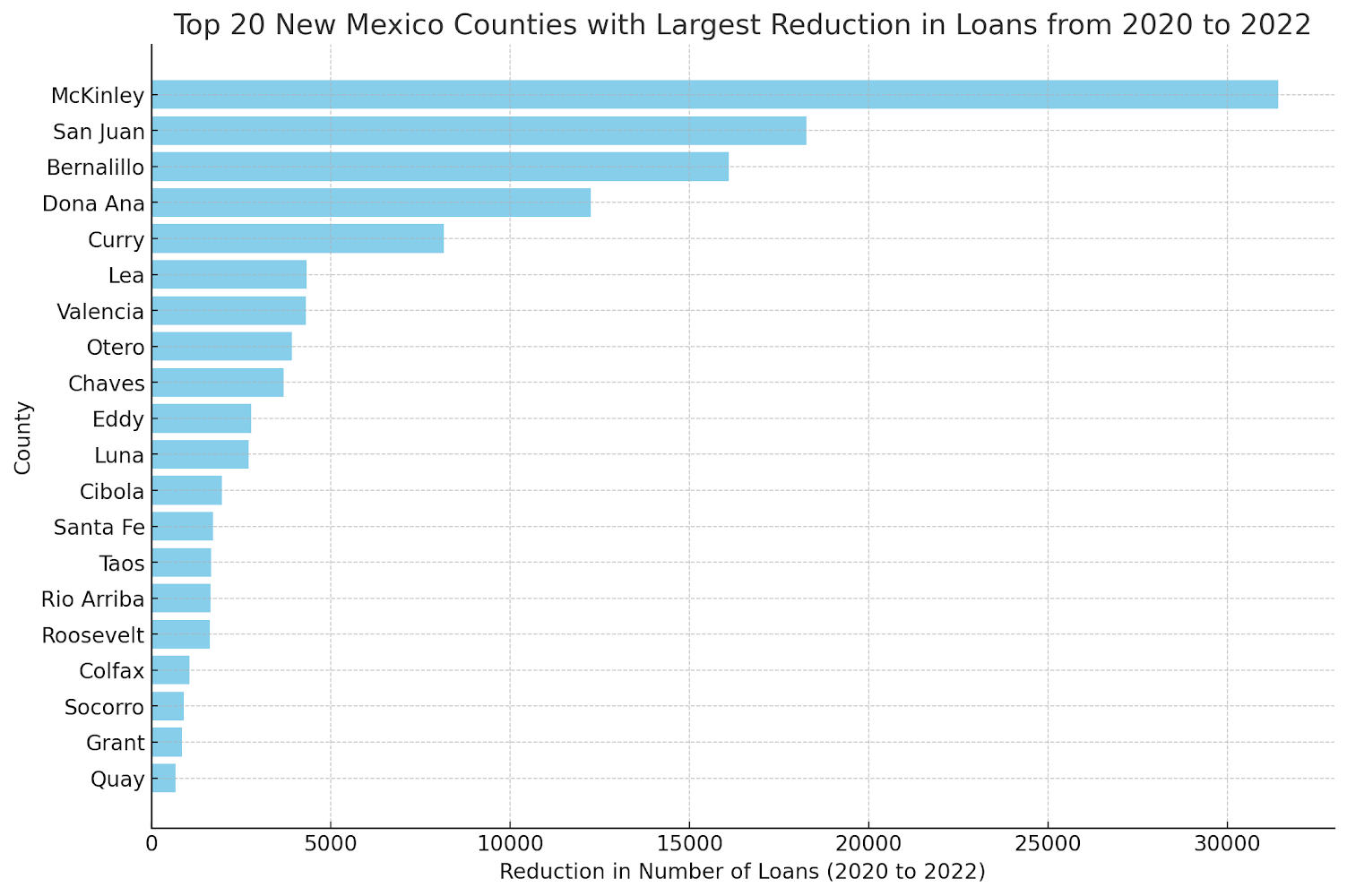

The impact is further illuminated through a county-level analysis. The "Top 20 New Mexico Counties with Largest Reduction in Loans from 2020 to 2022" graph highlights this. Major counties like McKinley, San Juan, and Bernalillo saw significant decreases in the number of loans, reflecting a widespread reduction across New Mexico. This statewide trend, spanning urban and rural areas alike, underscores the pervasive impact of the bill on loan accessibility.

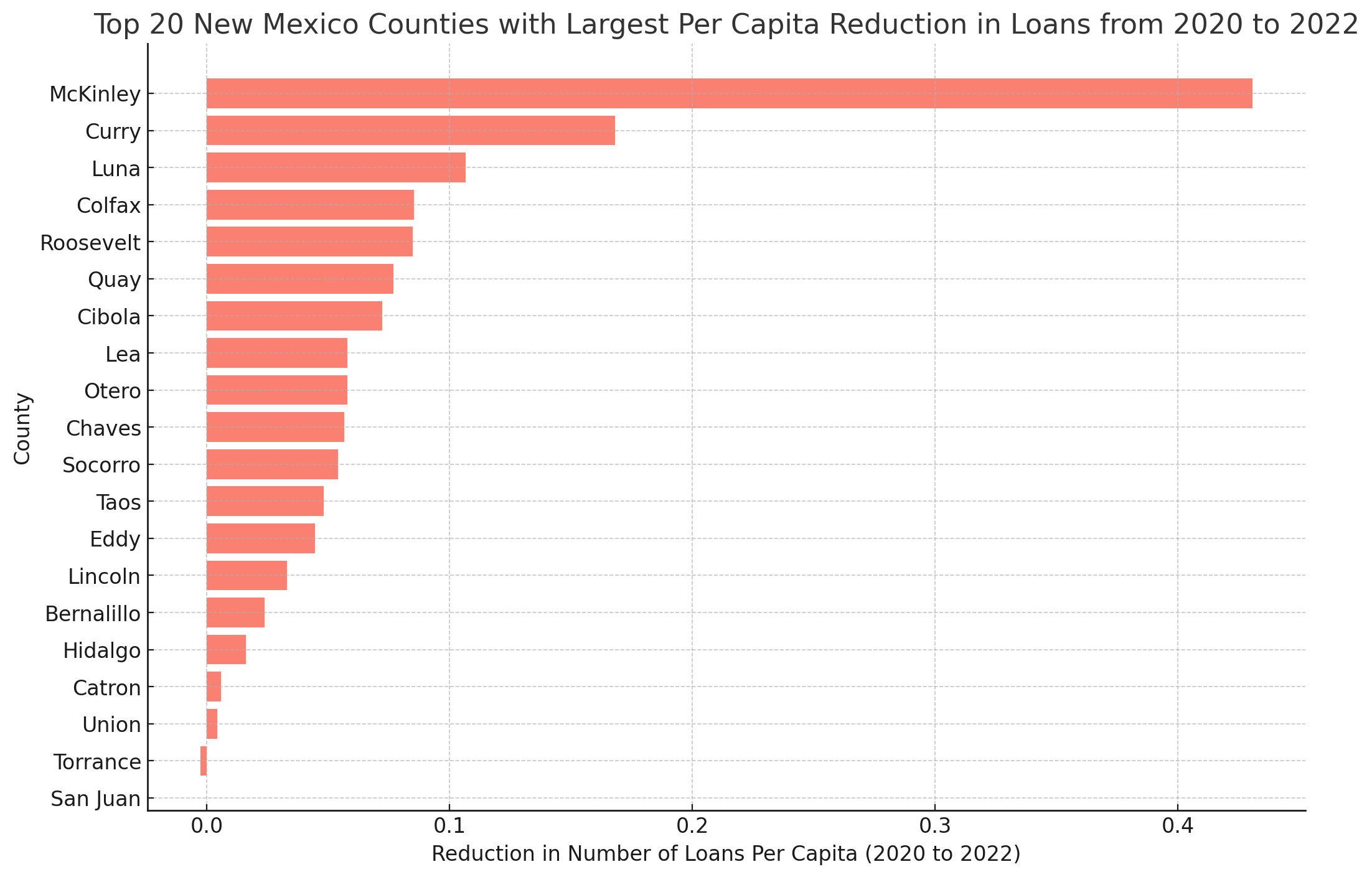

Per Capita Impact: Exposing Disproportionate Effects

A more nuanced understanding emerges from the per capita analysis, as shown in the "Top 20 New Mexico Counties with Largest Per Capita Reduction in Loans from 2020 to 2022" graph. This analysis reveals that certain communities, such as McKinley County, were disproportionately affected. The per capita loan reduction highlights how certain areas, especially those that previously relied heavily on small loans, face severe credit access challenges.

Banks' Involvement and Its Limitations

After the bill's implementation, a few major banks like Wells Fargo and Bank of America offered small loans under $1,000. However, these loans were predominantly available to existing customers, often requiring a significant banking relationship history. This approach inherently excluded a large segment of the population, particularly those without existing bank accounts or those newly seeking credit.

Recent Developments: Bank Branch Closures

Adding to the complexity, recent announcements of branch closures by Wells Fargo in New Mexico and plans by Bank of America to close additional branches nationwide reflect a shrinking physical banking presence. These closures, alongside the banks’ focus on digital banking services, further limit access to credit for potential new customers, particularly the unbanked and those in rural areas.

The Unbanked and Underbanked: Left Out of the Equation

The pivot towards digital banking and the prerequisite of existing banking relationships have particularly disadvantaged the unbanked and underbanked populations. Contrary to the advocates' beliefs, these individuals have found themselves with even fewer options to meet their financial needs in the wake of House Bill 132. The inability of these consumers to access the newly offered bank loans underscores a critical oversight in the bill's implications. It is critical to understand the real-world consequences of banking access in New Mexico and the belief that these banks would provide needed credit access to unbanked and underbanked New Mexicans.

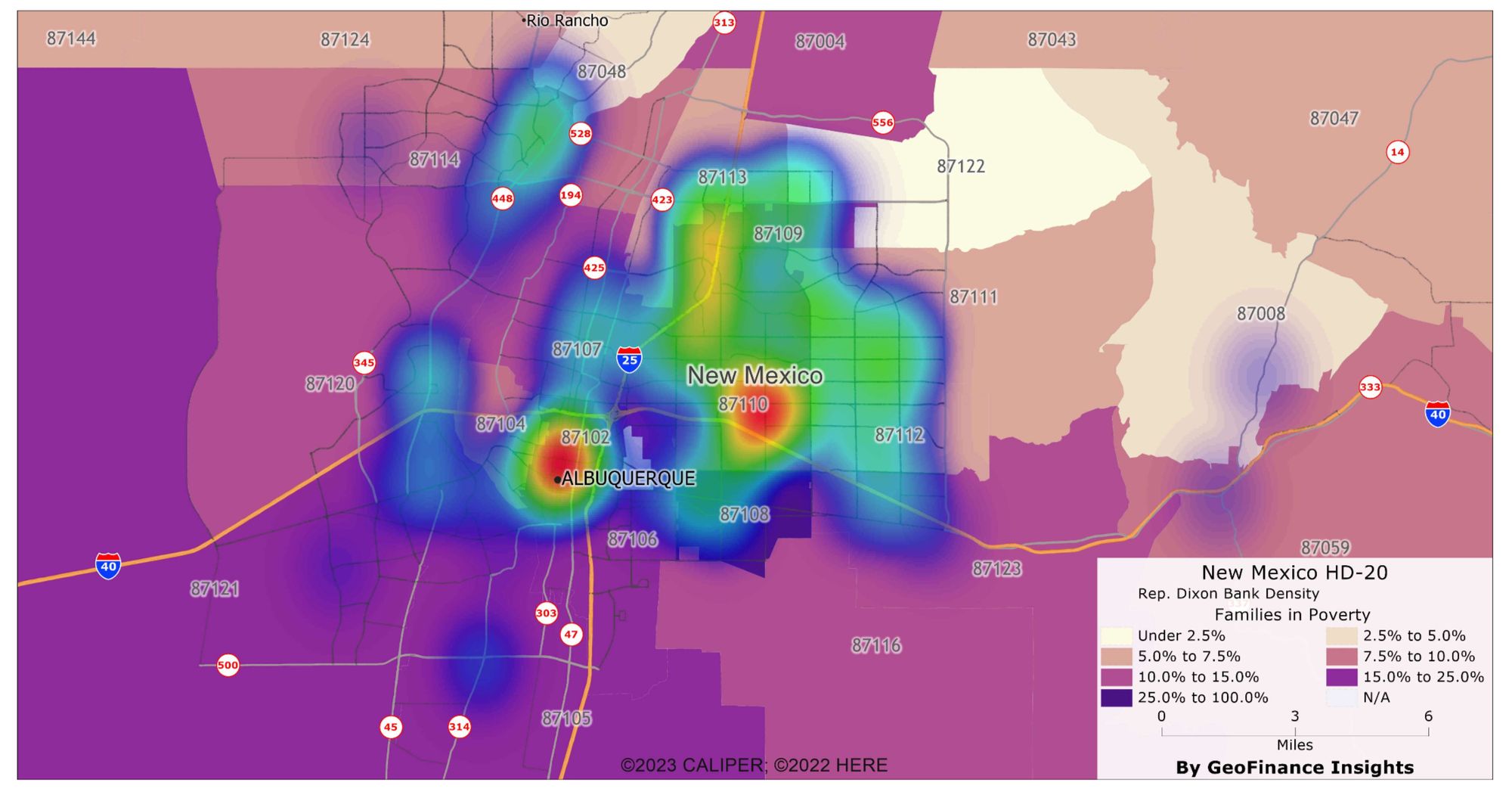

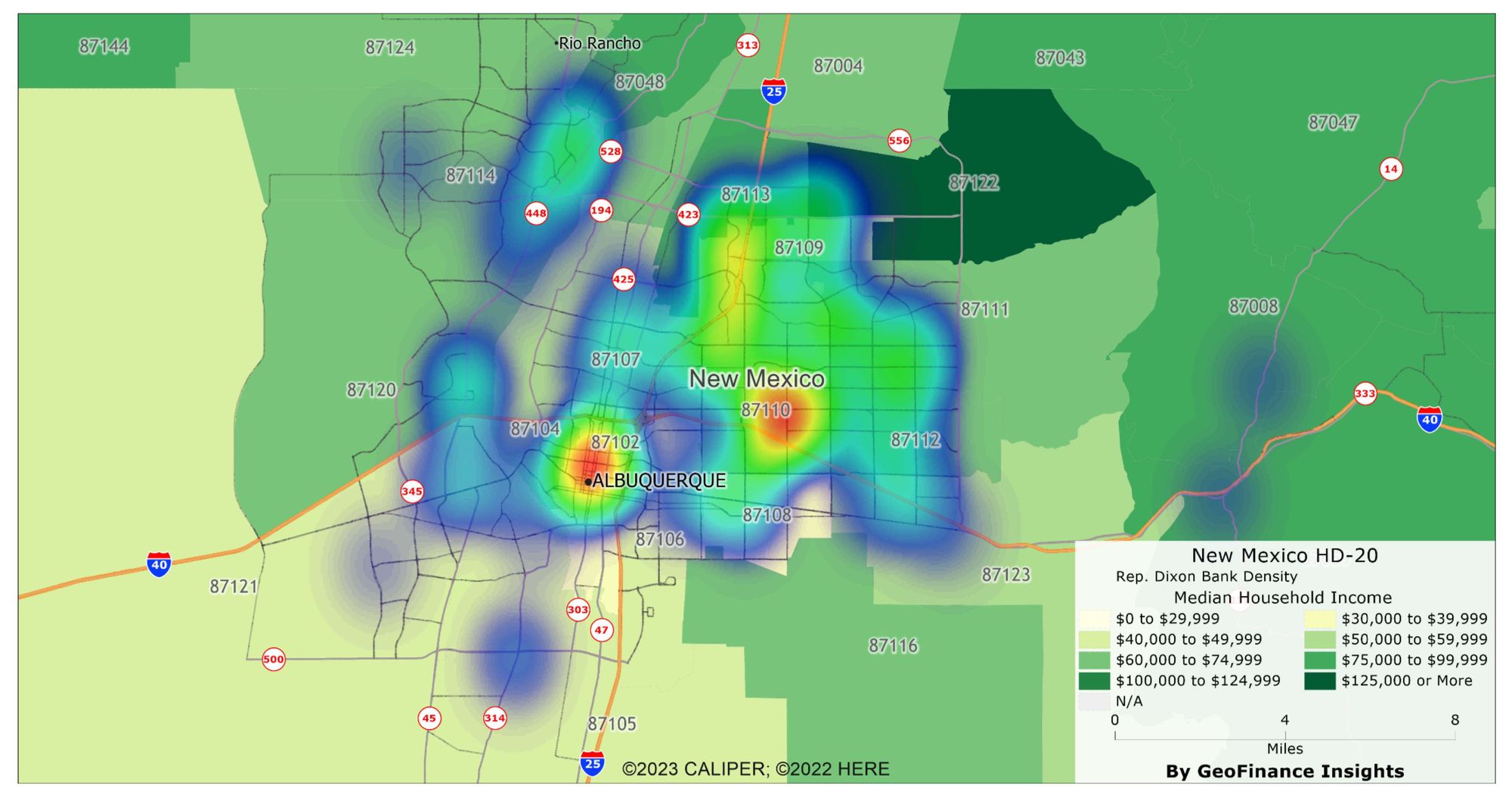

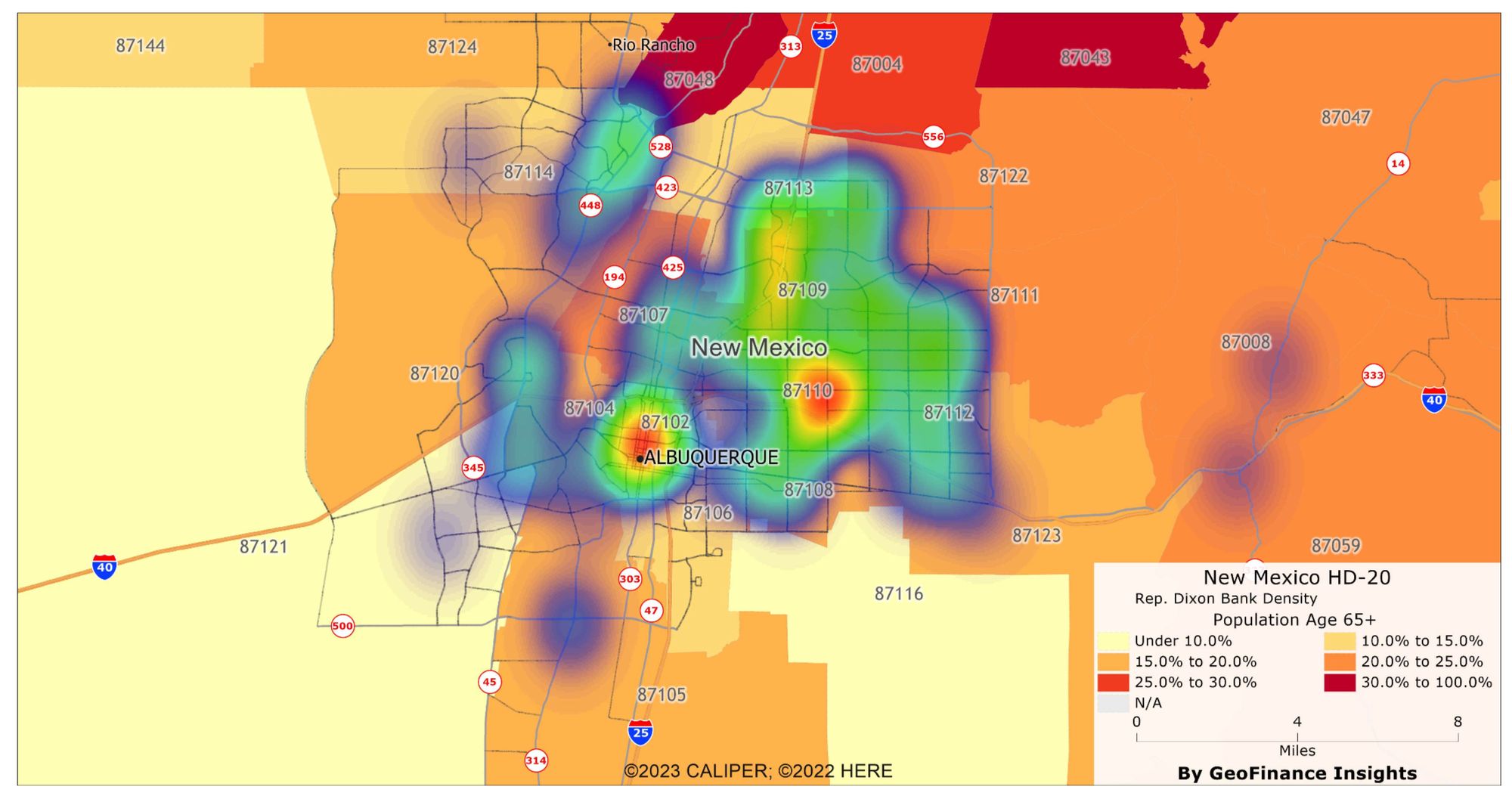

According to a report by KRQE in Albuquerque, Wells Fargo closed three bank branches in New Mexico. The branches in Santa Teresa and Bosque Farms, which is about 20 miles south of Albuquerque, closed on Oct. 4. The branch in Corrales, another Albuquerque suburb, closed on Aug. 16. Most significantly, the following maps display the impact of bank deserts on socioeconomically challenged neighborhoods in Representative Meredith Dixon's district, one of HB 132's primary sponsors.

House District 20 Banks by Poverty Status

House District 20 Banks by Median Income

House District 20 Banks by Education

Conclusion: Revisiting the Implications of House Bill 132

The data and subsequent banking trends post the enactment of House Bill 132 tell a story different from those suggested by its advocates. While the intent was to eliminate high-APR installment lending and replace it with bank-provided alternatives, the actual outcome has been a reduction in accessible credit options for many New Mexicans. This analysis clearly demonstrates the need to reevaluate the bill’s impact. Lawmakers, industry leaders, and advocates must come together to find more inclusive financial solutions that truly serve the needs of all New Mexicans, especially those most vulnerable. The conclusion is inescapable: House Bill 132, though well-intentioned, has led to unintended consequences that require immediate attention and action.