Navigating the Competitive Waters: A Comprehensive Analysis of the Dallas Plumbing Market

A Snapshot of Financial Health and Business Size

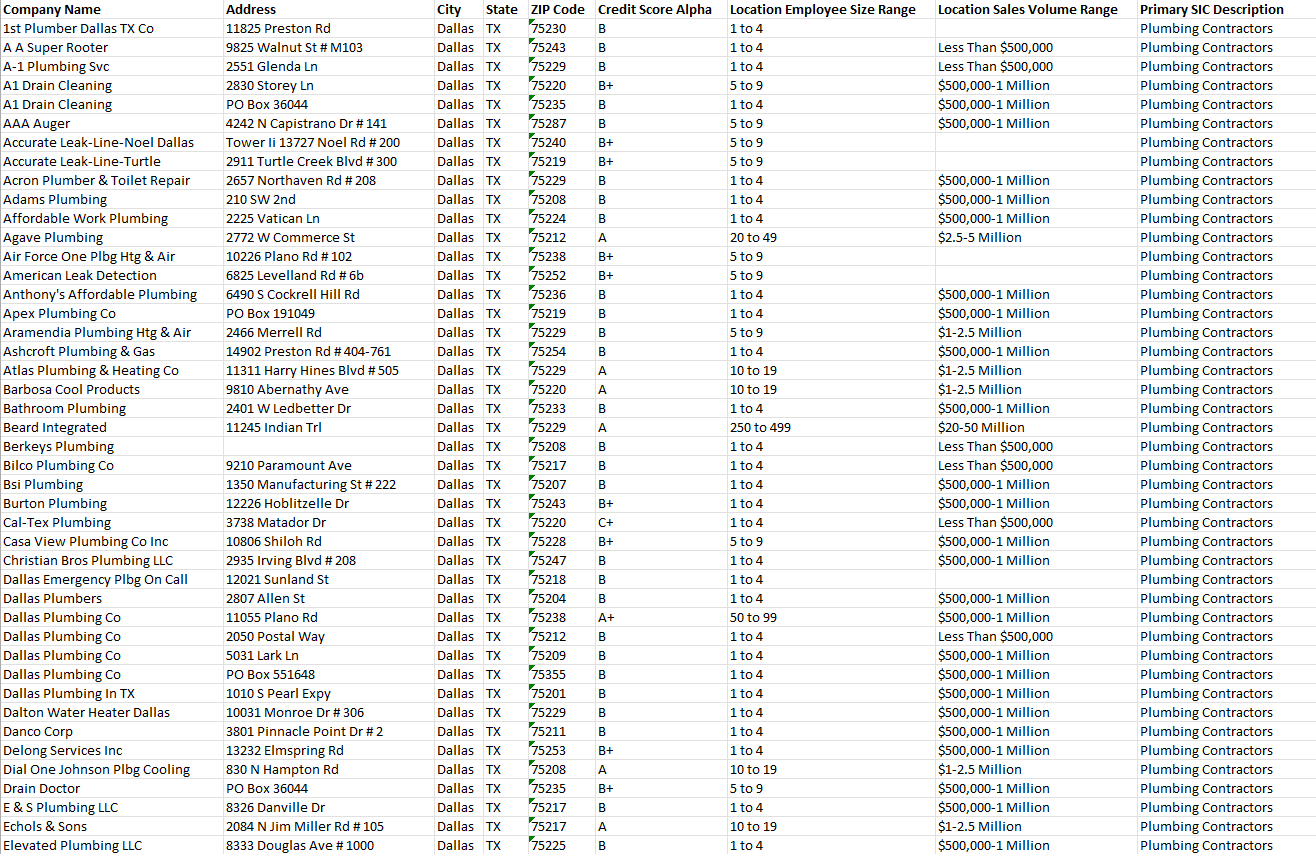

The Dallas plumbing market presents a fascinating picture of financial stability and entrepreneurial spirit. Our visual explorations reveal a landscape where most plumbing companies hold a 'B' credit score, reflecting good financial health and creditworthiness. These businesses, primarily small-scale with 1 to 4 employees, form the backbone of the industry, indicating a market teeming with agile and capable service providers. Despite this density of smaller players, the potential for growth shines through, especially for those eyeing uncharted territories within the market's niches.

The visualizations above illustrate the competitive landscape of plumbing companies in Dallas based on credit score distribution, employee size range, and sales volume range:

- Credit Score Distribution: The bar chart shows that the majority of companies have a 'B' credit score, indicating good credit standing. A significant number also have a 'B+' score, with fewer companies in the 'A', 'C+', 'A+', and 'U' categories. This distribution suggests overall good creditworthiness among the companies, with most being in the middle to upper tiers of credit scores.

- Employee Size Range Distribution: The second chart reveals a heavy concentration of companies with 1 to 4 employees, highlighting the prevalence of small-scale operations within the Dallas plumbing industry. There's a notable drop as employee size ranges increase, indicating that larger operations are much less common.

- Sales Volume Range Distribution: The final chart shows that a substantial number of companies have sales volumes between $500,000 to $1 million, with a decreasing number of companies reporting lower or higher sales volumes. This suggests a moderate level of business activity for most companies, with a few outliers achieving significantly higher sales.

These charts collectively provide a comprehensive overview of the competitive dynamics within the Dallas plumbing industry, indicating a market dominated by small, financially healthy companies. Growth and market entry opportunities may exist by targeting specific niches, leveraging creditworthiness, and focusing on strategic expansion to move into higher sales volume categories.

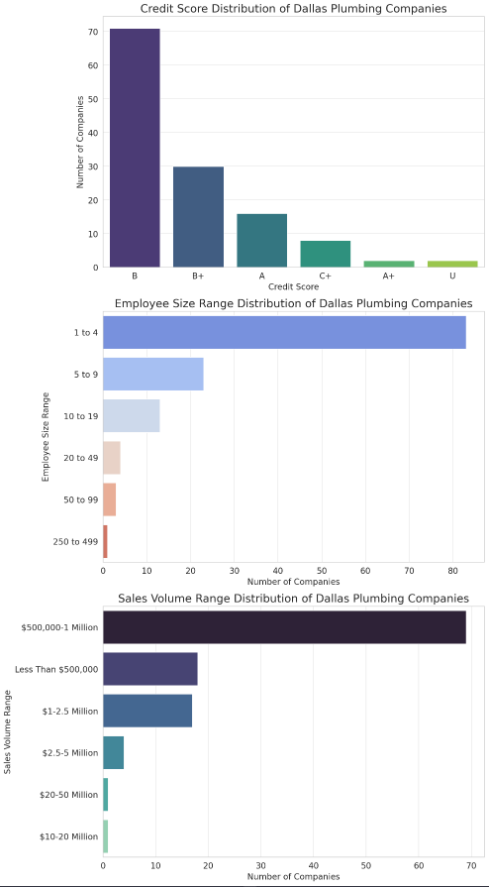

The Historical Canvas: Residential Age and Plumbing Demand

As we delve deeper into the Dallas plumbing market, we discover that the age of residential properties paints a detailed picture of service demand. Our historical analysis underscores the significance of the construction era, revealing that older homes, particularly those built between 1940 and 1979, present lucrative opportunities for maintenance and repair services. As the houses age, the demand for plumbing services grows, providing a roadmap for plumbers to target areas with the greatest need. This strategic insight allows plumbing businesses to optimize their service offerings and expand into neighborhoods hungry for expert plumbing solutions.

Decoding the Dallas Plumbing Market

In this section, we delve into the dynamics of the Dallas plumbing market, exploring how the age of residential properties intersects with the distribution of plumbing services. We'll consider the implications of historic building periods on the current and future demand for plumbing, providing a strategic overview that professionals in the industry can use to navigate the competitive landscape. This analysis will serve as a foundation for understanding market opportunities and challenges faced by plumbing businesses in various Dallas neighborhoods.

The age of homes is a critical factor for plumbers assessing the competitive market:

- Maintenance and Repair Opportunities: Older homes are more likely to require maintenance and repairs, increasing demand for plumbing services. Plumbers can target areas with older housing stock to capitalize on the increased need for their services.

- Competitive Strategy: Understanding the distribution of plumbers in relation to the age of homes can help plumbing businesses strategize where to offer their services to avoid oversaturation and maximize potential business.

- Market Potential: By analyzing the density of plumbers and the construction date of homes, plumbers can identify underserved areas or neighborhoods ripe for business expansion, especially where older homes are prevalent and may need more frequent plumbing upgrades or repairs.

Homes Built Between 1940 and 1949 With Drive-Time Rings

Plumbers are spread relatively evenly with a few denser clusters. The homes from this period are likely to need plumbing services due to their age, making these areas potentially good for business.

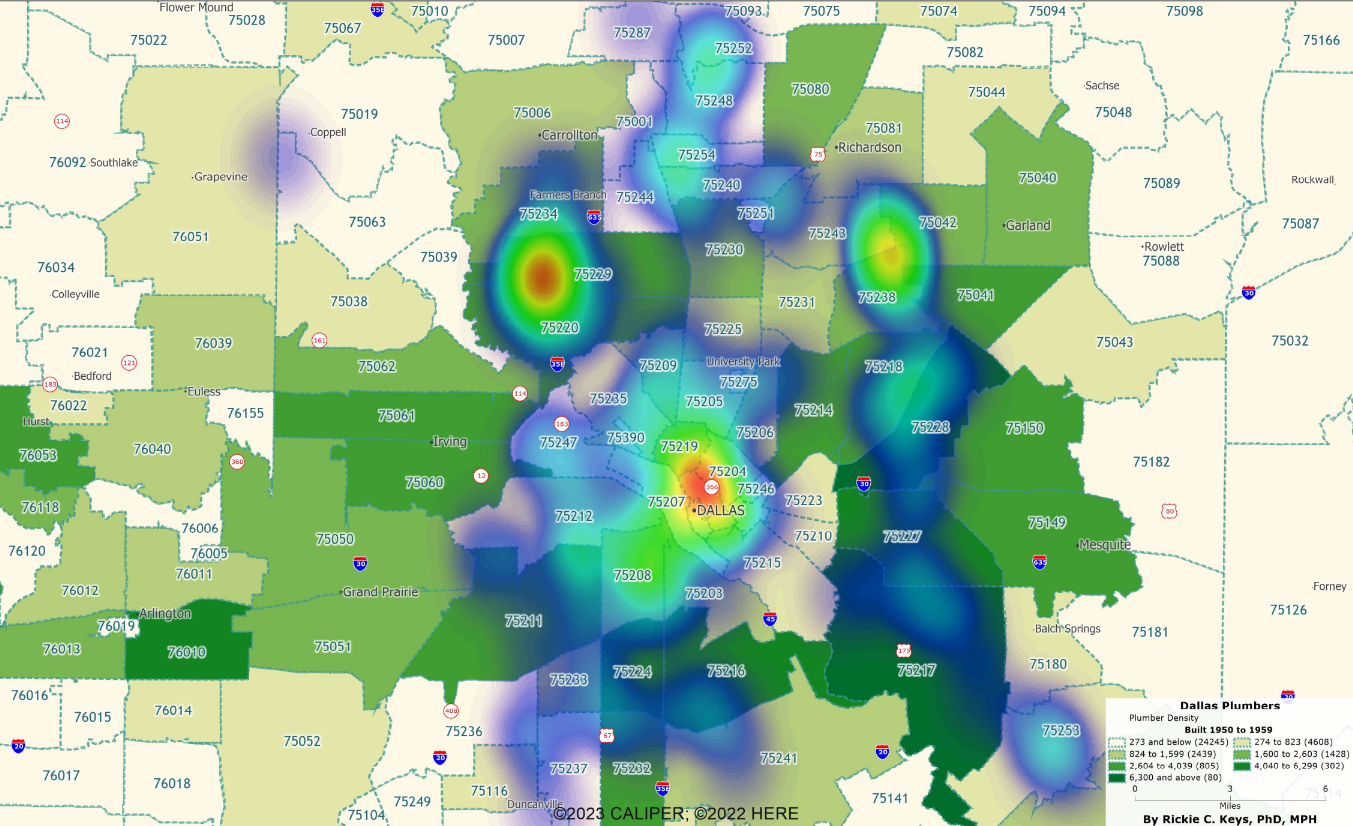

Homes Built Between 1950 and 1959

There's an increased density of plumbers in certain areas, suggesting a competitive market. The homes built during this decade might be undergoing renovations, requiring plumbing work.

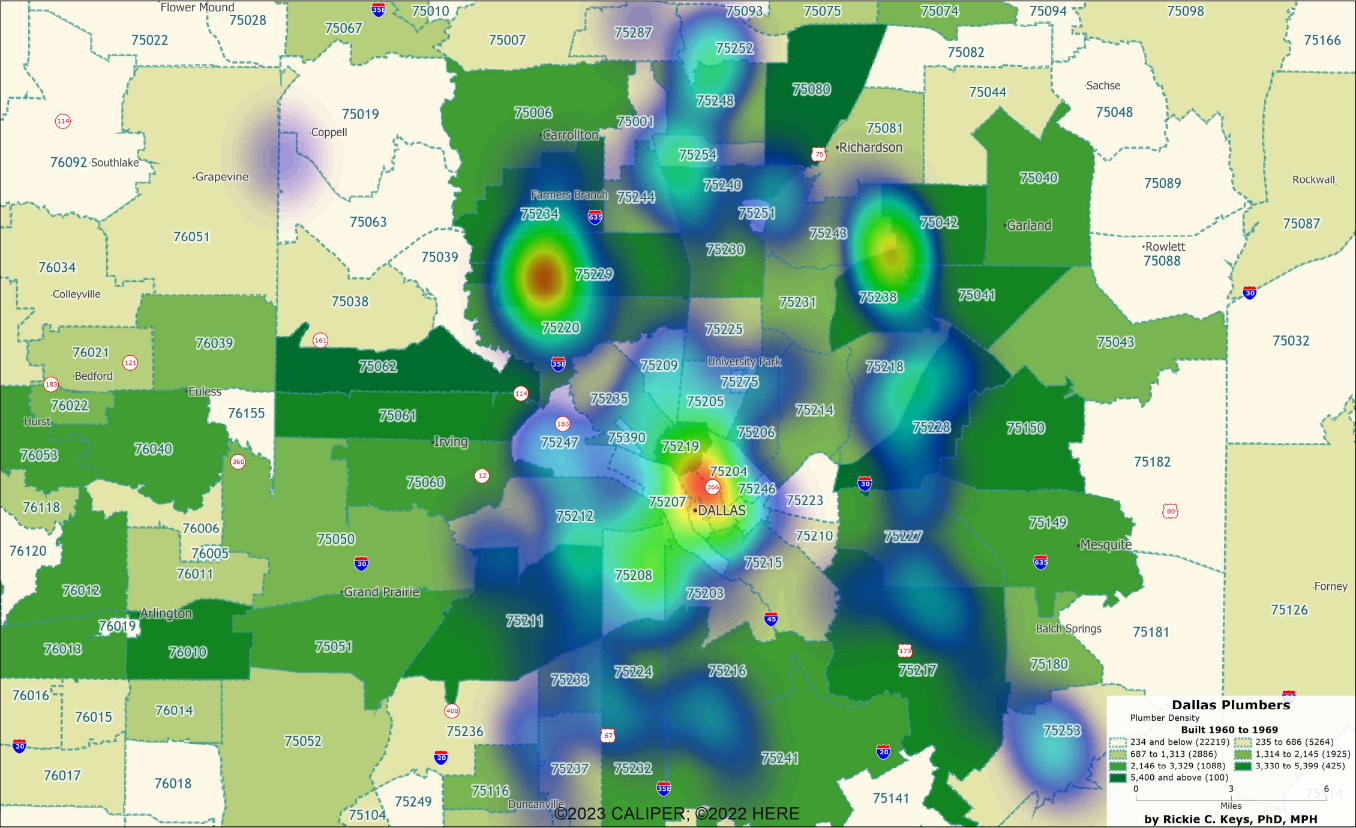

Homes Built Between 1960 and 1969

The plumber density appears to be higher in certain regions, possibly correlating with the number of homes built during this time. These areas might have established plumbing needs and services.

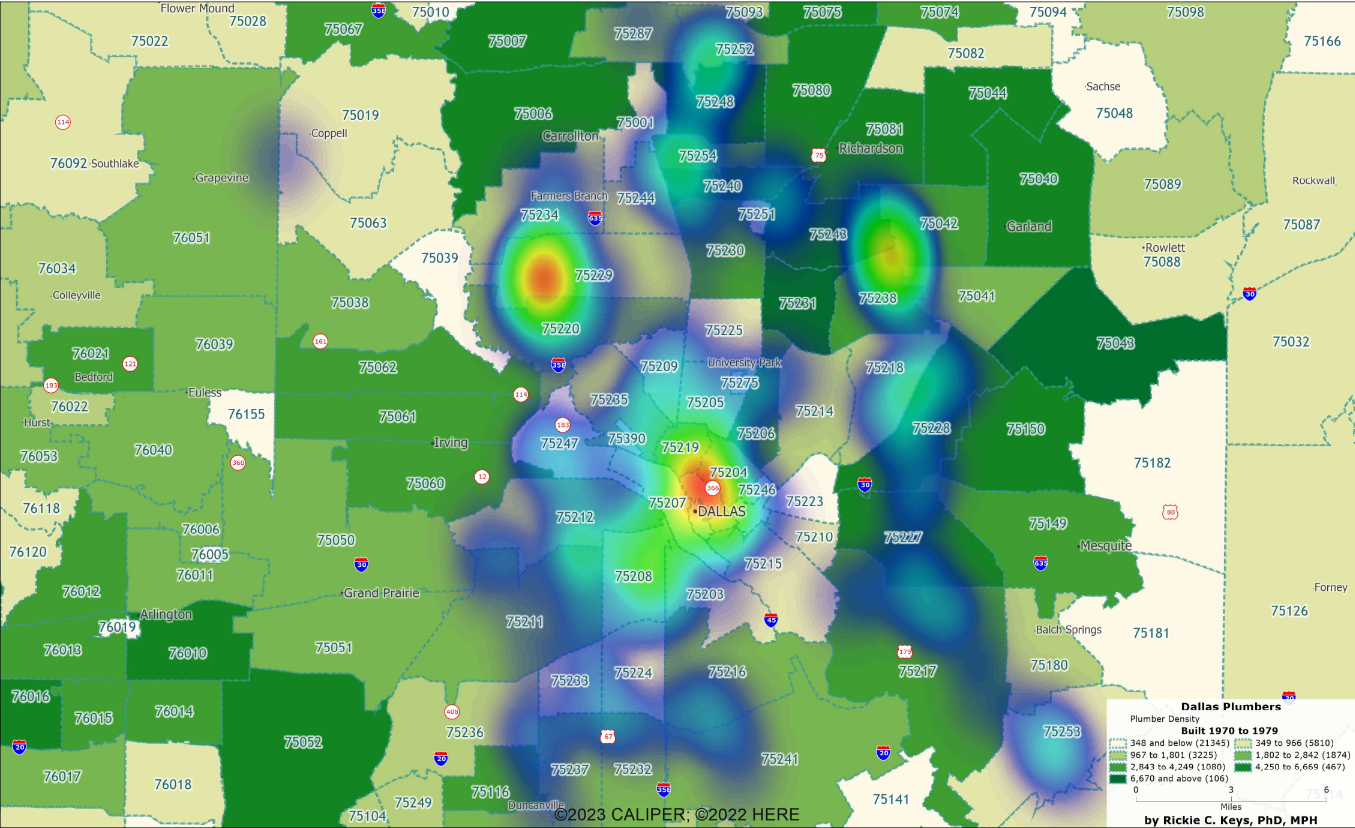

Homes Built Between 1970 and 1979

The density of plumbers is varied, with some regions appearing saturated. As the houses are newer compared to the previous decades, the demand for plumbing might be for modernization rather than repair.

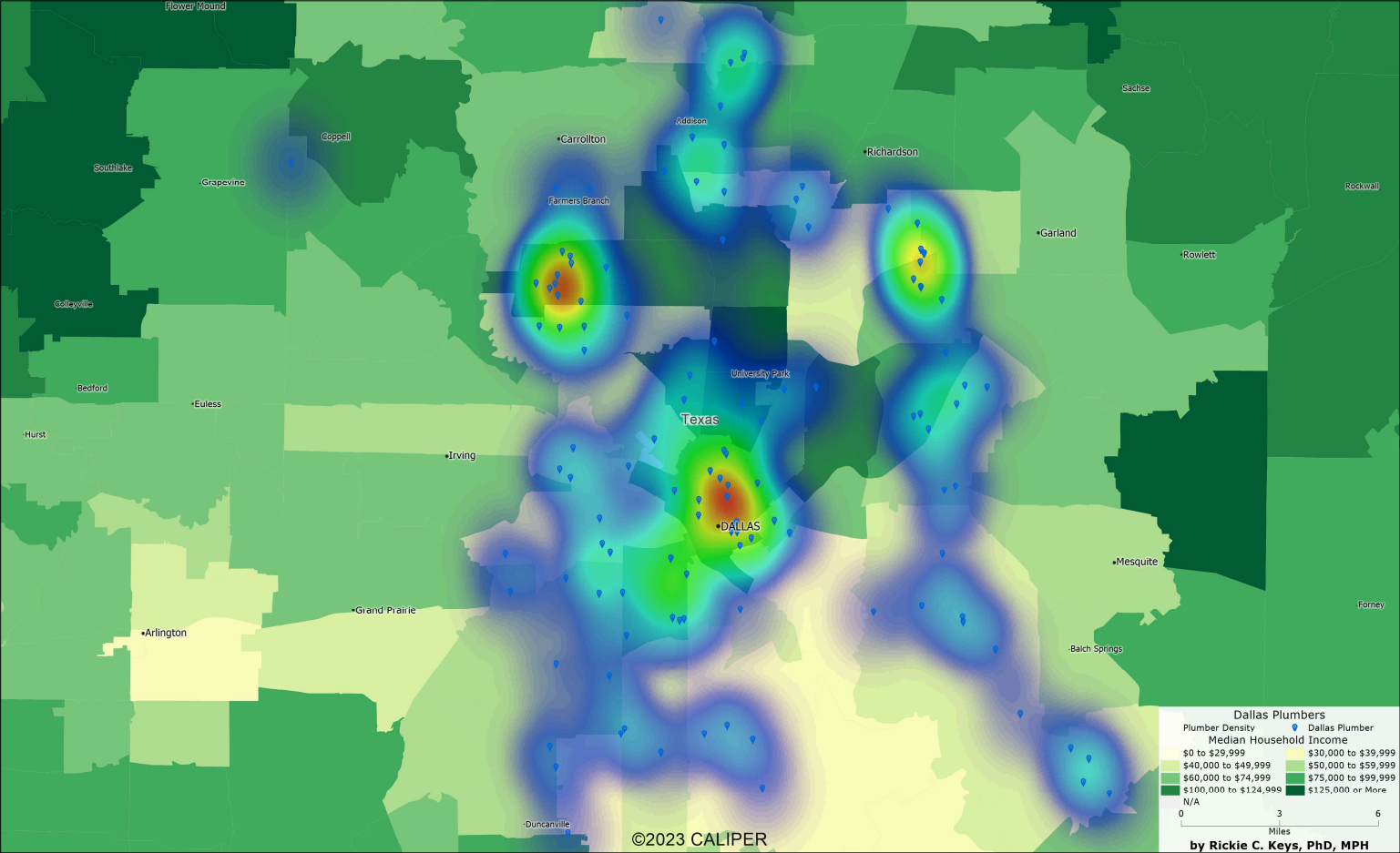

Demographics and Income: The Pulse of Potential

Turning our attention to the broader demographic trends, we observe the critical role of population density in shaping business prospects. Areas with higher population density are veritable hotbeds of opportunity, boasting larger customer bases ready to tap into quality plumbing services. Coupled with income mapping, we gain a nuanced understanding of the market's financial landscape. Neighborhoods with higher average incomes may exhibit a propensity for premium plumbing services, guiding businesses to tailor their marketing efforts and service portfolios to meet the expectations of these affluent areas.

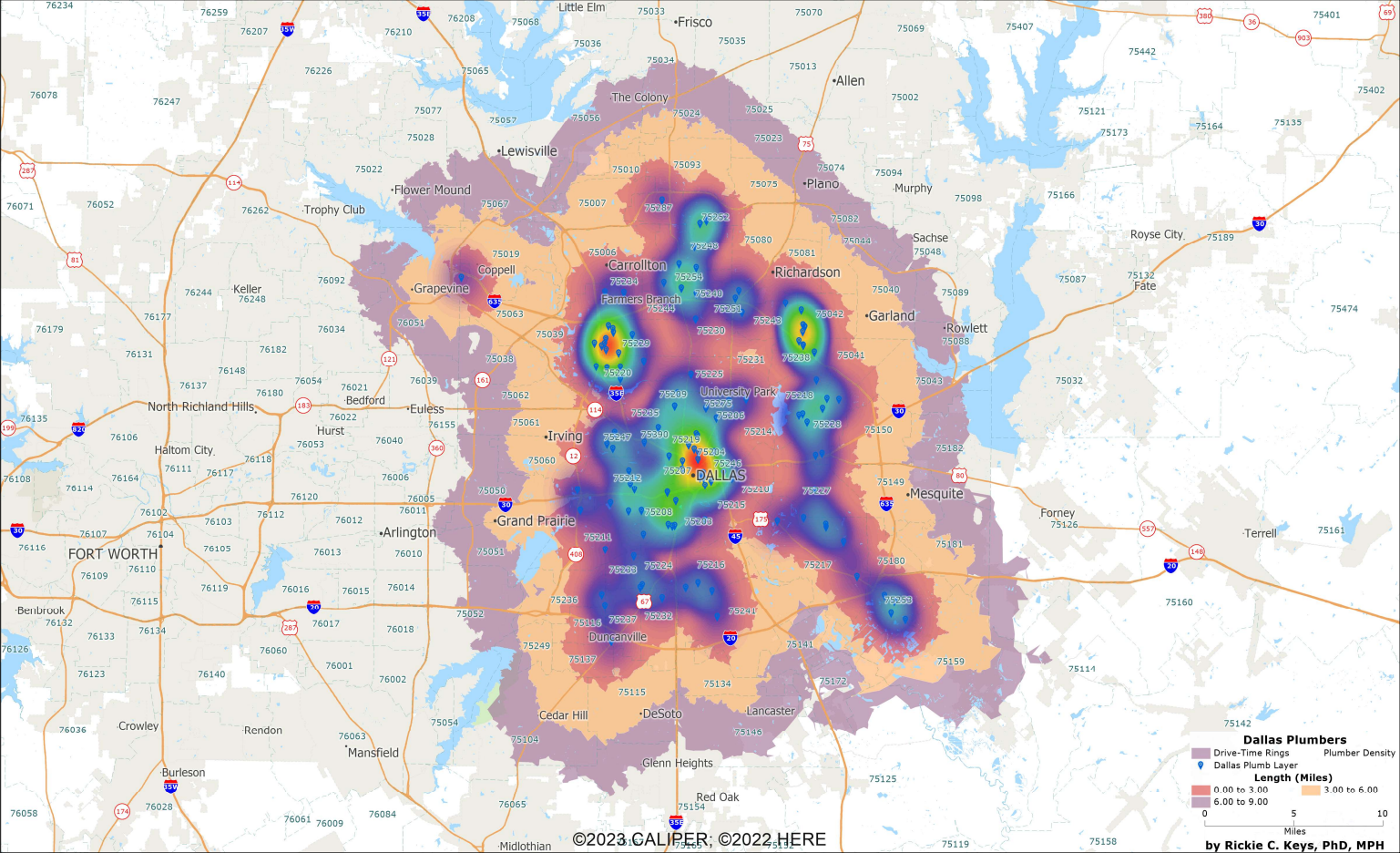

ZIP Code Density Map

Next, we'll focus on the population density of Dallas by ZIP code. This demographic mapping is essential for plumbers to understand where their services are most likely to be in demand. A higher concentration of residents can signify a larger customer base, which is vital for business growth and service deployment strategies.

Dallas Population

Dallas Population Density

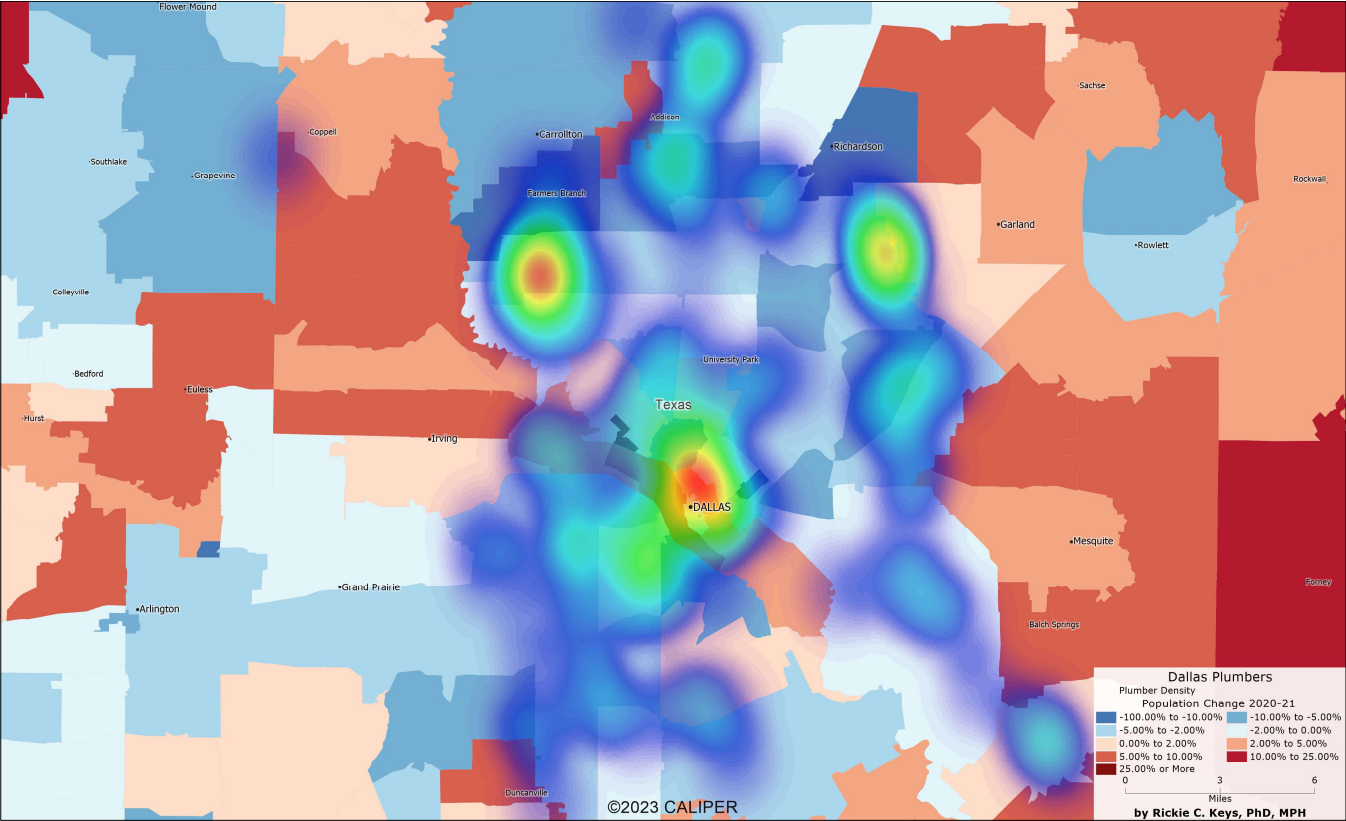

Dallas Population Change

Income Level Map

In this segment, we'll visualize the average household income across Dallas neighborhoods. Income levels can be indicative of a customer's ability to pay for services and willingness to invest in higher-end plumbing solutions. This information helps in tailoring services and marketing to different income brackets.

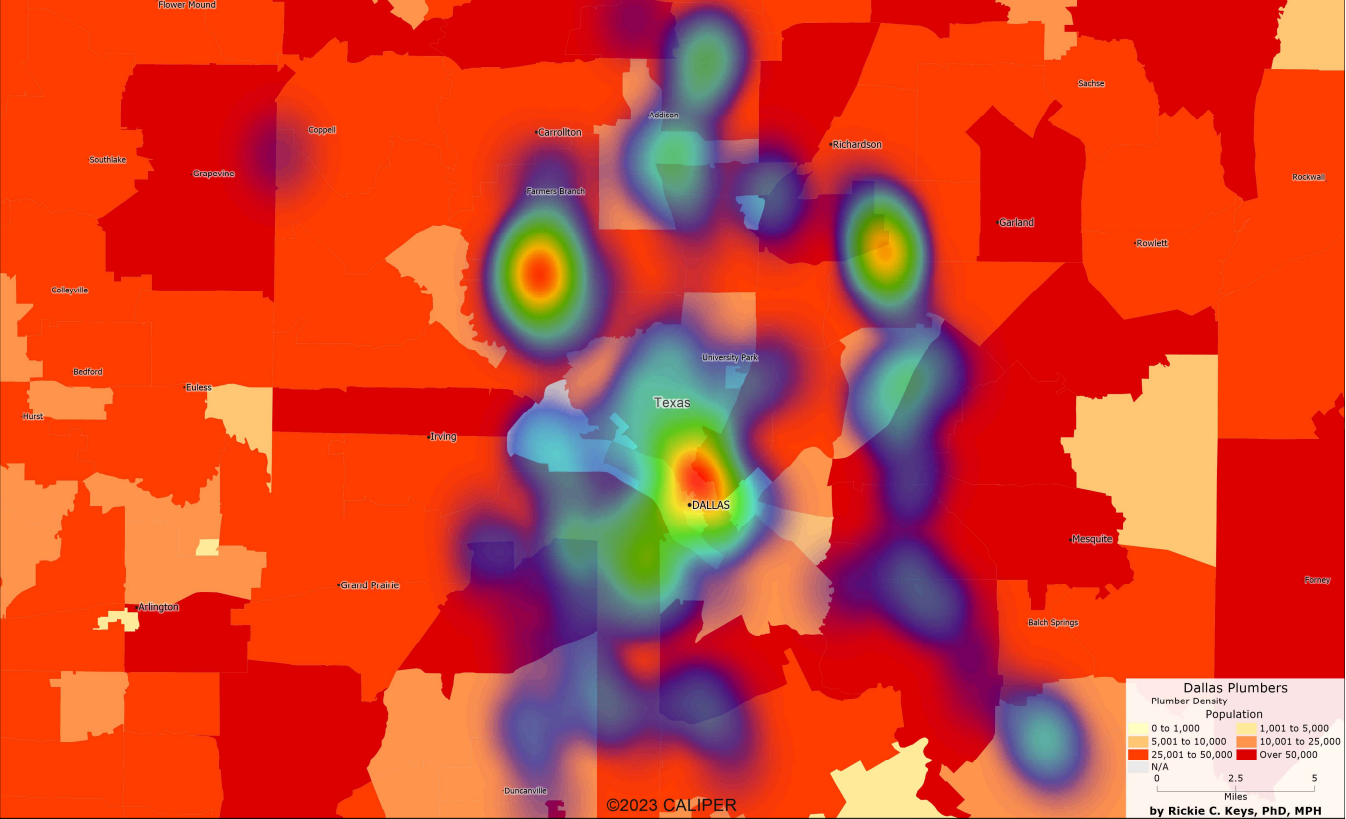

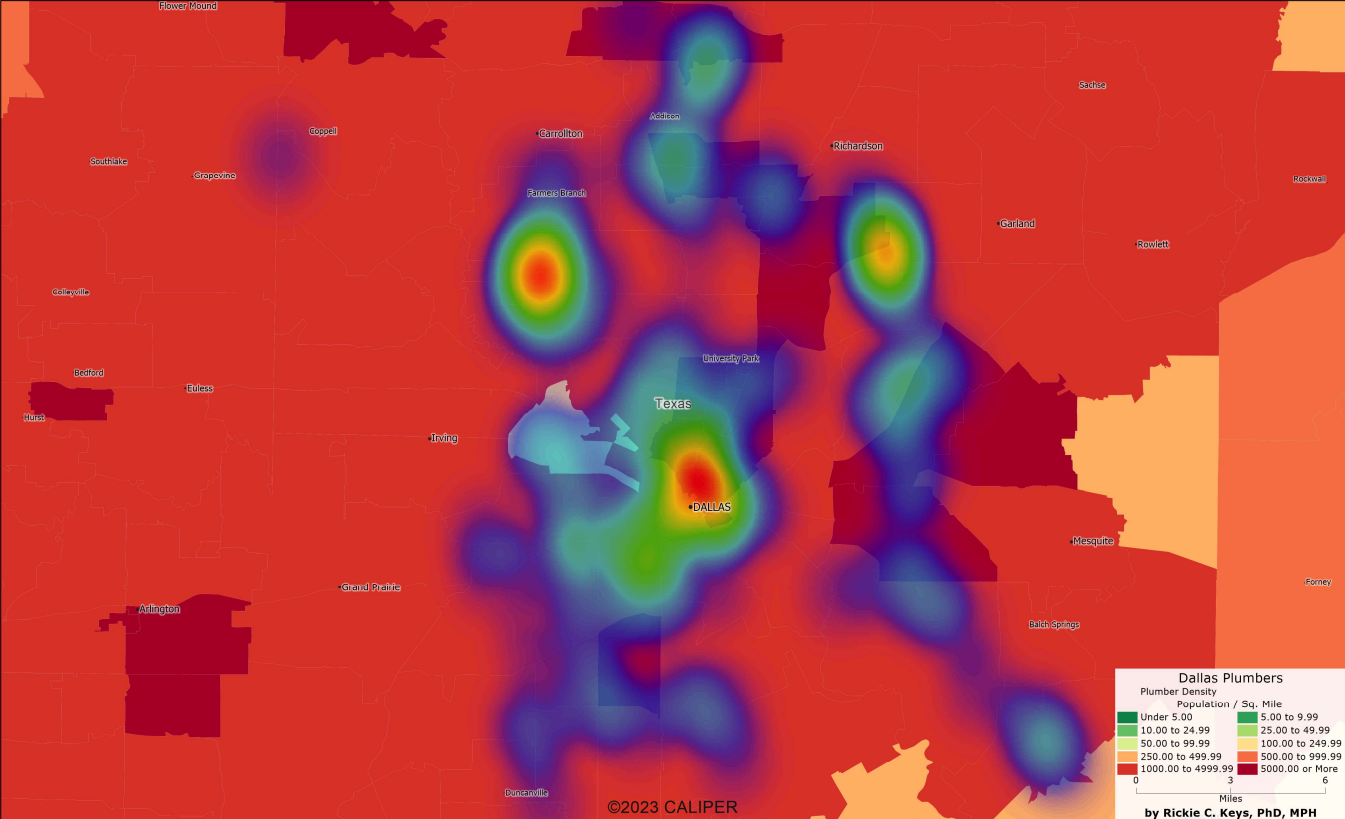

Heatmapping Competition: Finding the Sweet Spots

Our competitive analysis culminates in a heatmap that vividly displays the intensity of plumbing businesses across Dallas. This visualization acts as a strategic beacon, highlighting both saturated zones and areas with room for growth. For plumbing businesses, this map is a strategic tool for navigating the competitive currents, enabling them to identify the best locations for market entry and customer acquisition, ensuring they remain distinct and successful in a sea of competitors.

Business Competition Heatmap

This heatmap will illustrate the intensity of competition among plumbing businesses across Dallas. Identifying hotspots of high and low business activity enables companies to strategize market entry and understand the competitive landscape, which is crucial for differentiation and customer acquisition.

Conclusion

In conclusion, the Dallas plumbing market presents a landscape ripe with opportunities, colored by the historical context of residential development and underscored by a robust fabric of financial viability. The concentration of small, financially sound plumbing companies lays the groundwork for a competitive yet promising environment. With a strategic focus, businesses can harness the potential of areas with older homes and tailor their services to meet the increasing demand for maintenance and renovations. Meanwhile, demographic and income insights provide a compass for targeting the most lucrative markets, where the propensity to invest in quality plumbing services intersects with the capacity to do so.

As Dallas continues to grow and evolve, the plumbing industry must adapt to the shifting currents of competition and customer needs. The key to longevity and success in such a market lies in intelligent data utilization to inform business strategies. By mapping out competition and potential, plumbing businesses can navigate with precision, tapping into underserved neighborhoods or leveraging high-income areas. Ultimately, those who approach the market with a blend of analytical foresight and service excellence will thrive and set the standard for plumbing services in the vibrant heart of Texas.